Shareholders Will Probably Hold Off On Increasing Launch Tech Company Limited's (HKG:2488) CEO Compensation For The Time Being

Key Insights

- Launch Tech will host its Annual General Meeting on 25th of April

- CEO Louis Liu's total compensation includes salary of CN¥4.28m

- The total compensation is 90% higher than the average for the industry

- Launch Tech's EPS grew by 57% over the past three years while total shareholder return over the past three years was 442%

Performance at Launch Tech Company Limited (HKG:2488) has been reasonably good and CEO Louis Liu has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 25th of April. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for Launch Tech

How Does Total Compensation For Louis Liu Compare With Other Companies In The Industry?

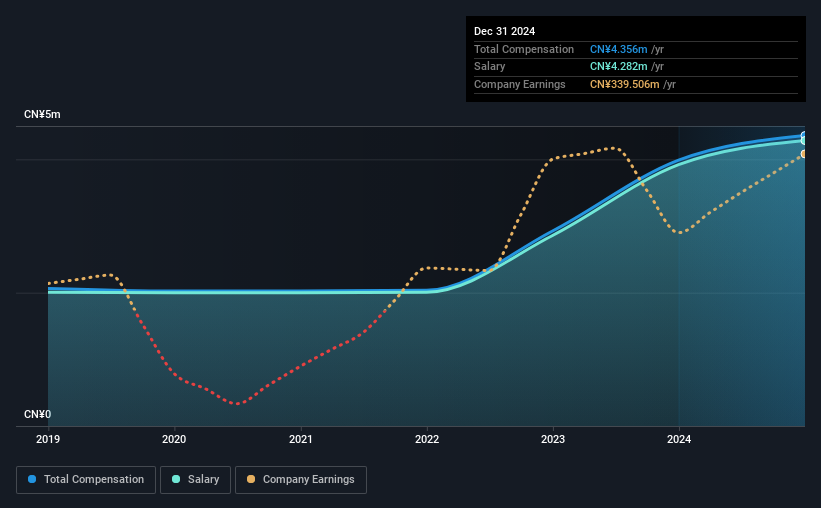

According to our data, Launch Tech Company Limited has a market capitalization of HK$4.0b, and paid its CEO total annual compensation worth CN¥4.4m over the year to December 2024. Notably, that's an increase of 9.3% over the year before. We note that the salary portion, which stands at CN¥4.28m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the Hong Kong Auto Components industry with market capitalizations between HK$1.6b and HK$6.2b, we discovered that the median CEO total compensation of that group was CN¥2.3m. Hence, we can conclude that Louis Liu is remunerated higher than the industry median. Furthermore, Louis Liu directly owns HK$769m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥4.3m | CN¥3.9m | 98% |

| Other | CN¥75k | CN¥67k | 2% |

| Total Compensation | CN¥4.4m | CN¥4.0m | 100% |

On an industry level, around 83% of total compensation represents salary and 17% is other remuneration. Launch Tech has gone down a largely traditional route, paying Louis Liu a high salary, giving it preference over non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Launch Tech Company Limited's Growth Numbers

Launch Tech Company Limited has seen its earnings per share (EPS) increase by 57% a year over the past three years. In the last year, its revenue is up 18%.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Launch Tech Company Limited Been A Good Investment?

Most shareholders would probably be pleased with Launch Tech Company Limited for providing a total return of 442% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Louis receives almost all of their compensation through a salary. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Launch Tech that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English