Shoucheng Holdings' (HKG:697) Dividend Will Be Reduced To HK$0.0164

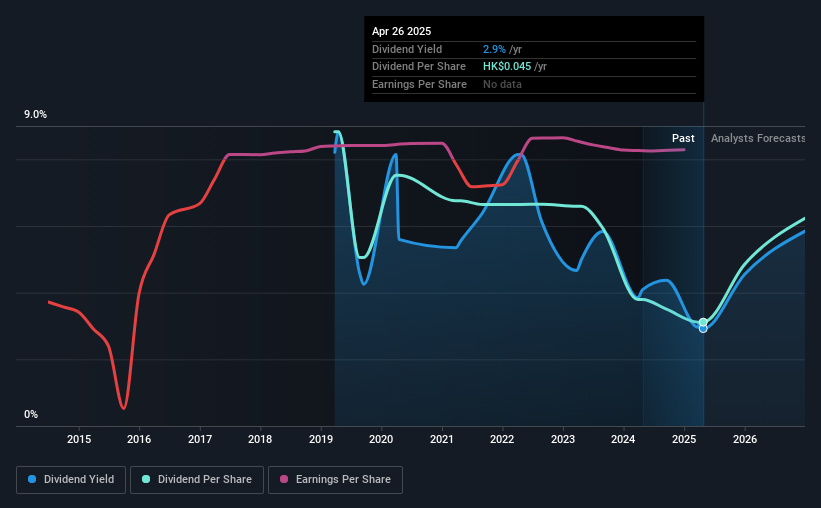

Shoucheng Holdings Limited (HKG:697) has announced that on 7th of August, it will be paying a dividend ofHK$0.0164, which a reduction from last year's comparable dividend. Based on this payment, the dividend yield will be 2.9%, which is lower than the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Shoucheng Holdings' stock price has increased by 52% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Shoucheng Holdings' Payment Could Potentially Have Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. At the time of the last dividend payment, Shoucheng Holdings was paying out a very large proportion of what it was earning and 168% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

Over the next year, EPS is forecast to expand by 103.9%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 58% which would be quite comfortable going to take the dividend forward.

Check out our latest analysis for Shoucheng Holdings

Shoucheng Holdings' Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The dividend has gone from an annual total of HK$0.128 in 2019 to the most recent total annual payment of HK$0.045. Dividend payments have fallen sharply, down 65% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Is Doubtful

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. In the last five years, Shoucheng Holdings' earnings per share has shrunk at approximately 7.5% per annum. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

The Dividend Could Prove To Be Unreliable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The payments are bit high to be considered sustainable, and the track record isn't the best. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Shoucheng Holdings that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English