Asian Dividend Stocks To Enhance Your Portfolio

Amid signs of easing trade tensions between the U.S. and China, Asian markets have shown resilience, with key indices in China and Japan experiencing gains. In this environment, dividend stocks can provide a stable income stream and potential growth opportunities, making them an attractive option for investors seeking to enhance their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.65% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.23% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.99% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.94% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.56% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.00% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.04% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

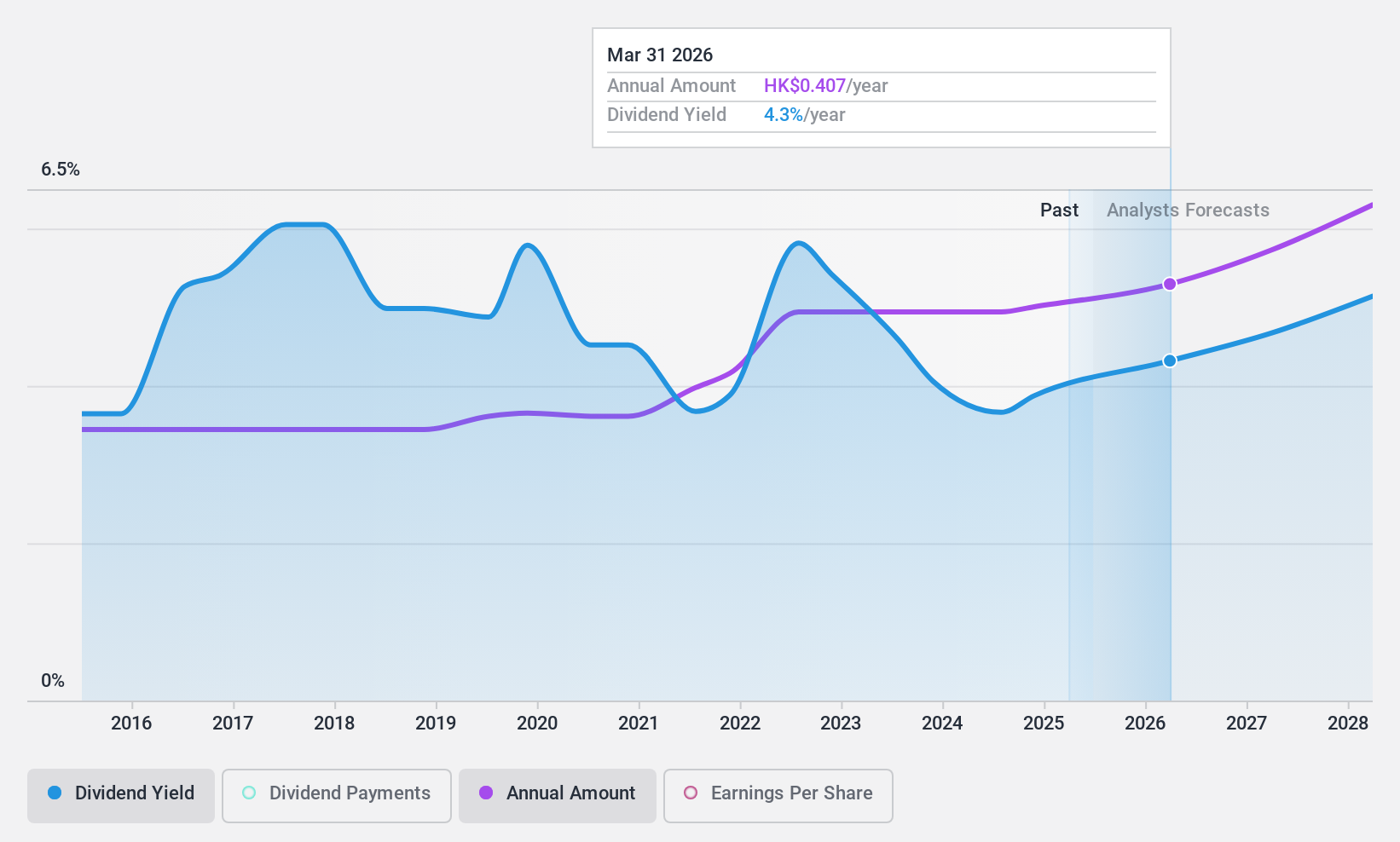

Lenovo Group (SEHK:992)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market cap of approximately HK$109.66 billion.

Operations: Lenovo Group's revenue is primarily derived from its Intelligent Devices Group (IDG) at $49.18 billion, followed by the Infrastructure Solutions Group (ISG) at $12.94 billion, and the Solutions and Services Group (SSG) at $8.13 billion.

Dividend Yield: 4.3%

Lenovo Group's dividend yield of 4.34% is modest compared to the Hong Kong market's top quartile, yet it remains attractive due to its stability and growth over the past decade. The dividends are well-covered by both earnings and cash flows, with payout ratios of 39.1% and 40.5%, respectively, indicating sustainability. Recent product innovations in AI-optimized storage solutions could potentially enhance Lenovo's financial performance further, supporting continued dividend reliability amidst evolving tech demands.

- Delve into the full analysis dividend report here for a deeper understanding of Lenovo Group.

- According our valuation report, there's an indication that Lenovo Group's share price might be on the cheaper side.

Tianjin Yiyi Hygiene ProductsLtd (SZSE:001206)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tianjin Yiyi Hygiene Products Co., Ltd specializes in the R&D, design, production, and sale of disposable pet and personal hygiene care products both in China and internationally, with a market cap of CN¥3.42 billion.

Operations: Tianjin Yiyi Hygiene Products Co., Ltd generates revenue from its disposable pet and personal hygiene care products sold domestically and internationally.

Dividend Yield: 4.7%

Tianjin Yiyi Hygiene Products Ltd's dividend yield of 4.65% is among the top in the CN market, though its reliability is questionable due to a volatile track record over four years. The dividends are covered by earnings and cash flows with payout ratios of 73.7% and 69.4%, respectively, suggesting sustainability despite recent decreases in payouts. The company has announced a share buyback program worth up to CNY 40 million, potentially supporting shareholder value amidst fluctuating dividend stability.

- Navigate through the intricacies of Tianjin Yiyi Hygiene ProductsLtd with our comprehensive dividend report here.

- Our valuation report here indicates Tianjin Yiyi Hygiene ProductsLtd may be undervalued.

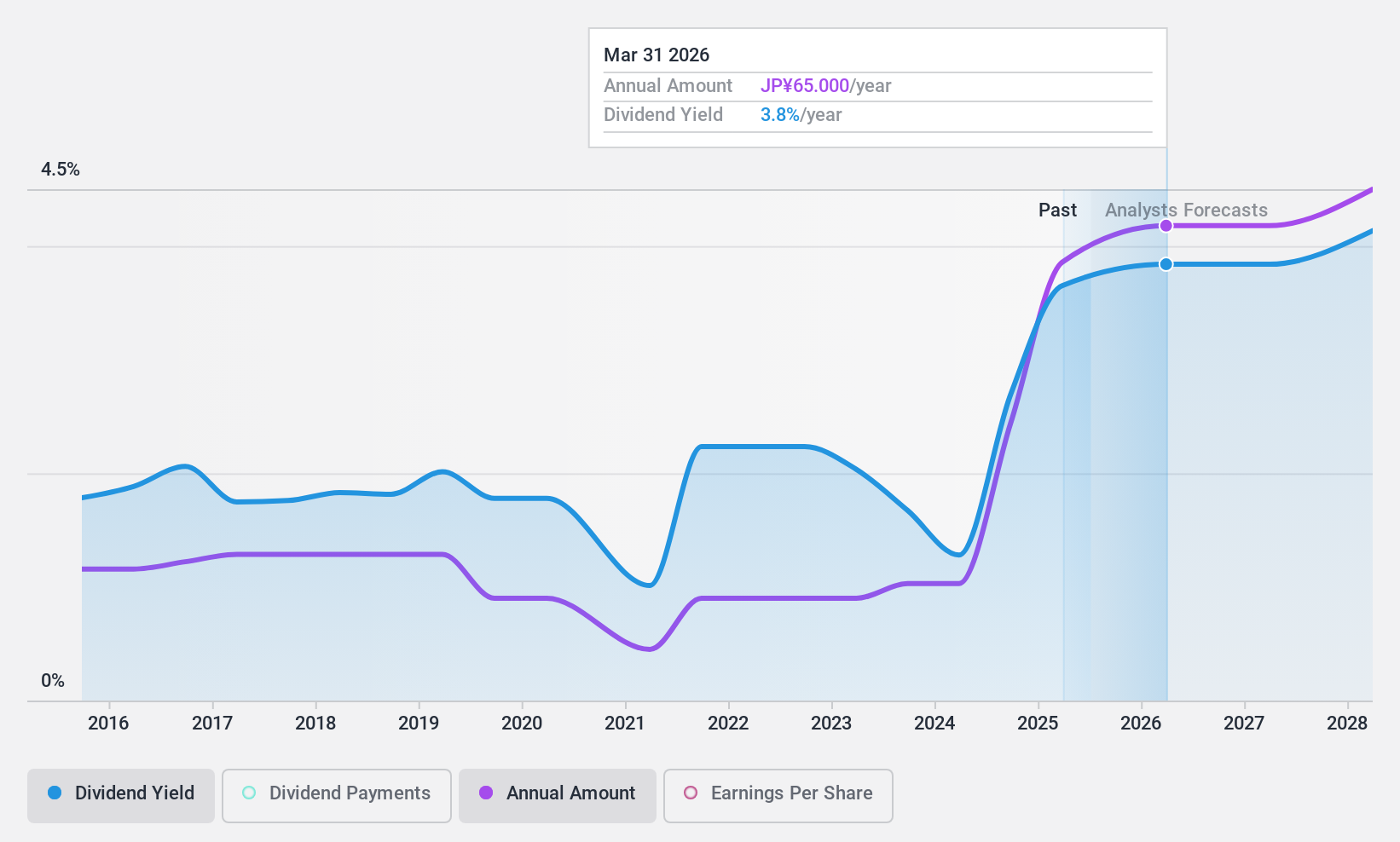

Sumitomo Riko (TSE:5191)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Riko Company Limited manufactures and sells automotive parts, with a market cap of ¥166.74 billion.

Operations: Sumitomo Riko Company Limited generates its revenue primarily from Automobile Supplies, contributing ¥572.90 billion, followed by General Industrial Supplies at ¥76.63 billion.

Dividend Yield: 3.7%

Sumitomo Riko's dividend yield of 3.74% is slightly below the top tier in Japan, with a history of volatility over the past decade. Despite this, dividends are well covered by earnings and cash flows, with low payout ratios of 19.7% and 19%, respectively. The stock trades at a favorable price-to-earnings ratio of 6.1x compared to the market average, indicating good value despite its unstable dividend track record and recent share price volatility.

- Unlock comprehensive insights into our analysis of Sumitomo Riko stock in this dividend report.

- The valuation report we've compiled suggests that Sumitomo Riko's current price could be quite moderate.

Summing It All Up

- Reveal the 1202 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English