Expert Outlook: ARM Holdings Through The Eyes Of 14 Analysts

In the last three months, 14 analysts have published ratings on ARM Holdings (NASDAQ:ARM), offering a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 8 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 5 | 5 | 0 | 0 | 0 |

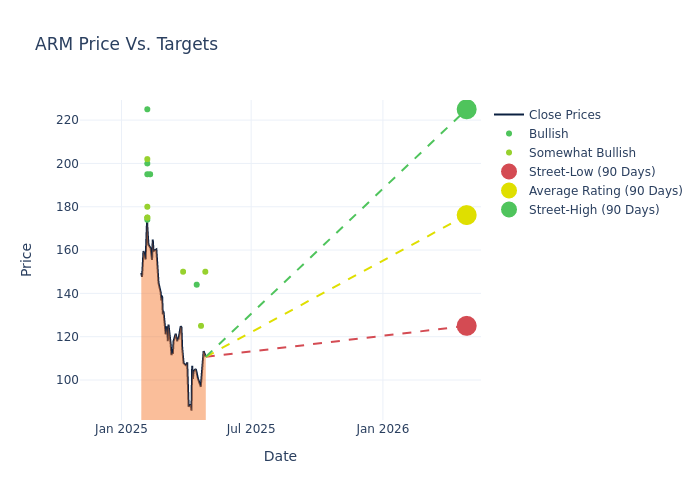

The 12-month price targets, analyzed by analysts, offer insights with an average target of $176.79, a high estimate of $225.00, and a low estimate of $125.00. This upward trend is apparent, with the current average reflecting a 4.34% increase from the previous average price target of $169.43.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive ARM Holdings. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Joe Quatrochi |Wells Fargo |Lowers |Overweight | $150.00|$185.00 | |Blayne Curtis |Barclays |Lowers |Overweight | $125.00|$155.00 | |Vivek Arya |B of A Securities |Lowers |Buy | $144.00|$180.00 | |Lee Simpson |Morgan Stanley |Lowers |Overweight | $150.00|$175.00 | |Ananda Baruah |Loop Capital |Raises |Buy | $195.00|$180.00 | |Joe Quatrochi |Wells Fargo |Raises |Overweight | $185.00|$162.00 | |Andrew Gardiner |Citigroup |Raises |Buy | $200.00|$170.00 | |Srini Pajjuri |Raymond James |Raises |Outperform | $175.00|$160.00 | |Mark Lipacis |Evercore ISI Group |Raises |Outperform | $202.00|$176.00 | |Hans Mosesmann |Rosenblatt |Raises |Buy | $225.00|$180.00 | |Vijay Rakesh |Mizuho |Raises |Outperform | $180.00|$160.00 | |Janardan Menon |Jefferies |Raises |Buy | $195.00|$170.00 | |Harlan Sur |JP Morgan |Raises |Overweight | $175.00|$160.00 | |Toshiya Hari |Goldman Sachs |Raises |Buy | $174.00|$159.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to ARM Holdings. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of ARM Holdings compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for ARM Holdings's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into ARM Holdings's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on ARM Holdings analyst ratings.

All You Need to Know About ARM Holdings

Arm Holdings is the intellectual property owner and developer of the ARM architecture, which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allow them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Both off-the-shelf and architectural customers pay a royalty fee per chip shipped.

ARM Holdings: Delving into Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3M period, ARM Holdings showcased positive performance, achieving a revenue growth rate of 19.3% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: ARM Holdings's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 25.64%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): ARM Holdings's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 4.05%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): ARM Holdings's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 3.04%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.04.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English