Here's Why Jilin Province Huinan Changlong Bio-pharmacy (HKG:8049) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Jilin Province Huinan Changlong Bio-pharmacy (HKG:8049). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Quickly Is Jilin Province Huinan Changlong Bio-pharmacy Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Jilin Province Huinan Changlong Bio-pharmacy grew its EPS by 8.7% per year. That growth rate is fairly good, assuming the company can keep it up.

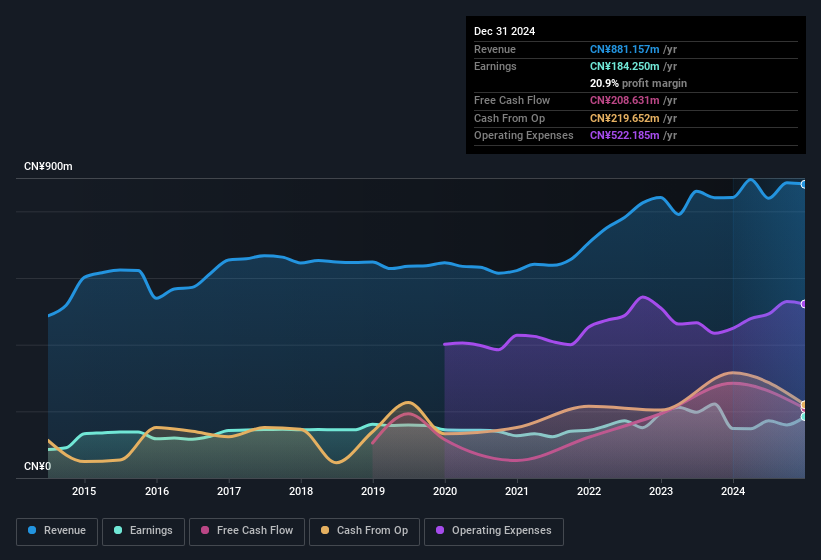

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Jilin Province Huinan Changlong Bio-pharmacy achieved similar EBIT margins to last year, revenue grew by a solid 4.7% to CN¥881m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Check out our latest analysis for Jilin Province Huinan Changlong Bio-pharmacy

Since Jilin Province Huinan Changlong Bio-pharmacy is no giant, with a market capitalisation of HK$1.1b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Jilin Province Huinan Changlong Bio-pharmacy Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Jilin Province Huinan Changlong Bio-pharmacy shares worth a considerable sum. As a matter of fact, their holding is valued at CN¥368m. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 35% of the shares on issue for the business, an appreciable amount considering the market cap.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Jilin Province Huinan Changlong Bio-pharmacy with market caps under CN¥1.5b is about CN¥1.7m.

Jilin Province Huinan Changlong Bio-pharmacy's CEO took home a total compensation package of CN¥776k in the year prior to December 2024. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Jilin Province Huinan Changlong Bio-pharmacy Worth Keeping An Eye On?

One positive for Jilin Province Huinan Changlong Bio-pharmacy is that it is growing EPS. That's nice to see. The fact that EPS is growing is a genuine positive for Jilin Province Huinan Changlong Bio-pharmacy, but the pleasant picture gets better than that. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. Before you take the next step you should know about the 1 warning sign for Jilin Province Huinan Changlong Bio-pharmacy that we have uncovered.

Although Jilin Province Huinan Changlong Bio-pharmacy certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English