SIGN UP

LOG IN

Top 2 Tech Stocks You May Want To Dump This Month

Benzinga·04/29/2025 11:18:58

Listen to the news

As of April 29, 2025, two stocks in the information technology sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Pony AI Inc (NASDAQ:PONY)

- Pony AI chief technology officer Lou Tiancheng told The Wall Street Journal that the company is getting closer to becoming profitable following a series of cost-cutting measures. Following the release of three new robotaxis at the Shanghai Auto Show last week, company executives reportedly said Pony AI can build its most advanced autonomous driving systems for 70% less than before. The company's stock jumped around 143% over the past five days and has a 52-week high of $23.88.

- RSI Value: 71.9

- PONY Price Action: Shares of Pony AI jumped 47.2% to close at $10.32 on Monday.

- Edge Stock Ratings: 91.92 Momentum score with Value at 93.51.

Pegasystems Inc (NASDAQ:PEGA)

- On April 22, Pegasystems reported better-than-expected first-quarter financial results. “Pega GenAI has dramatically transformed how we engage with our clients,” said Alan Trefler, Pega founder and CEO. “Pega solutions and our approach to AI enables clients to accelerate progress in reaching their digital and legacy transformation goals.” The company's stock gained around 36% over the past five days and has a 52-week high of $113.67.

- RSI Value: 70.5

- PEGA Price Action: Shares of Pegasystems fell 0.6% to close at $91.11 on Monday.

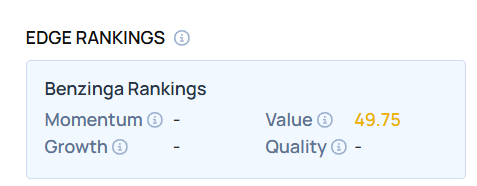

BZ Edge Rankings: Find out where other stocks stand—explore the full comparison now.

Read This Next:

Photo via Shutterstock

Risk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.