Preview: MGIC Investment's Earnings

MGIC Investment (NYSE:MTG) is set to give its latest quarterly earnings report on Wednesday, 2025-04-30. Here's what investors need to know before the announcement.

Analysts estimate that MGIC Investment will report an earnings per share (EPS) of $0.69.

Investors in MGIC Investment are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

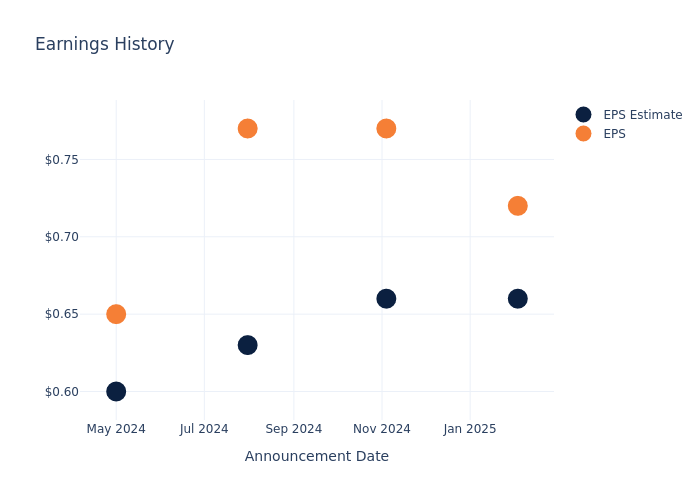

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.06, leading to a 1.79% increase in the share price on the subsequent day.

Here's a look at MGIC Investment's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.66 | 0.66 | 0.63 | 0.60 |

| EPS Actual | 0.72 | 0.77 | 0.77 | 0.65 |

| Price Change % | 2.0% | 1.0% | -1.0% | -0.0% |

Performance of MGIC Investment Shares

Shares of MGIC Investment were trading at $24.56 as of April 28. Over the last 52-week period, shares are up 19.51%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on MGIC Investment

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding MGIC Investment.

The consensus rating for MGIC Investment is Neutral, based on 4 analyst ratings. With an average one-year price target of $26.25, there's a potential 6.88% upside.

Peer Ratings Overview

This comparison focuses on the analyst ratings and average 1-year price targets of Mr. Cooper Gr and Walker & Dunlop, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Mr. Cooper Gr, with an average 1-year price target of $134.12, suggesting a potential 446.09% upside.

- Analysts currently favor an Outperform trajectory for Walker & Dunlop, with an average 1-year price target of $101.67, suggesting a potential 313.97% upside.

Snapshot: Peer Analysis

The peer analysis summary presents essential metrics for Mr. Cooper Gr and Walker & Dunlop, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| PennyMac Financial Servs | Outperform | 53.22% | $281.12M | 1.97% |

| Mr. Cooper Gr | Neutral | 3.74% | $343M | 1.81% |

| Walker & Dunlop | Outperform | 24.46% | $156.35M | 2.45% |

Key Takeaway:

MGIC Investment ranks at the top for Revenue Growth among its peers. It is in the middle for Gross Profit and Return on Equity.

Discovering MGIC Investment: A Closer Look

MGIC Investment Corp provides private mortgage insurance, other mortgage credit risk management solutions, and ancillary services. The insurance premiums that these customers pay for the protection accounts for close to majority of the company's total revenue. Investment income accounts for the remaining revenue. The company sells its insurance products in all states of the United States and in Puerto Rico. Its greatest exposure is in California, Florida, Texas, Pennsylvania, Ohio, Illinois, Virginia, North Carolina, Georgia and New York.

Unraveling the Financial Story of MGIC Investment

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Positive Revenue Trend: Examining MGIC Investment's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 6.16% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: MGIC Investment's net margin is impressive, surpassing industry averages. With a net margin of 61.27%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): MGIC Investment's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.53%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): MGIC Investment's ROA excels beyond industry benchmarks, reaching 2.79%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.12, MGIC Investment adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for MGIC Investment visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English