Alibaba Group Holding (NYSE:BABA) Debuts Qwen3 AI as Open Source Model Challenger

Alibaba Group Holding (NYSE:BABA) launched its Qwen3 AI models, a significant product innovation amid a broader market environment marked by downturns following GDP contraction. Despite the S&P 500 and Nasdaq experiencing declines of 0.9% and 1.3%, respectively, Alibaba's shares rose 23% over the last quarter, possibly buoyed by the company's advancements in AI and a substantial share buyback initiative. These company-specific moves likely provided a positive counterbalance to broader market trends, highlighting Alibaba's strategic focus on AI development and investment, contrasting with challenges seen by several major tech firms in the same period.

The launch of Alibaba's Qwen3 AI models and the share buyback initiative has potentially solidified its position in the AI and cloud sectors, reinforcing the narrative of strong revenue and earnings growth. Over the past year, the total return for shareholders, including dividends, amounted to 62.23%. This strong performance contrasts with a 9.9% return from the US market, highlighting Alibaba's relative outperformance. Notably, the company's share price rose by 23% over the last quarter alone, suggesting strong investor confidence in recent strategic moves.

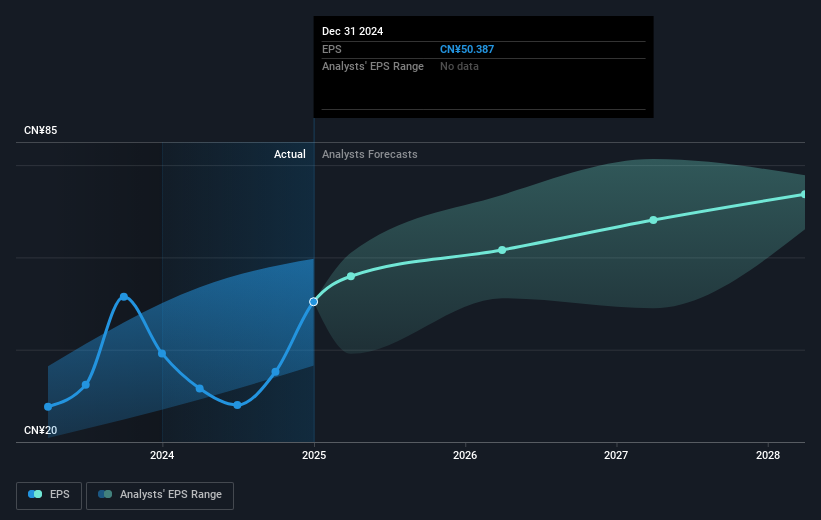

In terms of revenue and earnings forecasts, Alibaba's focus on AI and cloud investments, alongside partnerships such as with WeChat Pay, underpin expectations for long-term growth in these areas. Analysts forecast Alibaba's revenue to grow 7.8% annually over the next three years, with earnings projected to increase from CN¥85.8 billion to CN¥145.8 billion by January 2028. Despite these positive forecasts, the market price remains discounted compared to the analyst consensus price target of CN¥164.96, suggesting potential for growth aligned with projected earnings enhancements and margin improvements. Investors may consider whether the expected future PE ratio aligns with market and industry benchmarks while weighing potential risks like intense competition and significant capital expenditures.

Evaluate Alibaba Group Holding's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English