Humana (NYSE:HUM) Revises 2025 Earnings Guidance Despite Strong Q1 Performance

Humana (NYSE:HUM) recently reported significant growth in its Q1 earnings, with revenue and net income seeing substantial increases compared to the previous year. Nonetheless, the company revised its full-year earnings guidance downward, reflecting a more cautious outlook. Despite these developments, Humana's stock performance remained flat over the past week. During the same period, broader markets saw gains, bolstered by strong earnings from major tech companies. Humana's individual performance, including its earnings announcement, added weight to these broader market dynamics rather than countering them.

Humana's recent earnings growth and subsequent downward revision of its full-year guidance highlight a cautious approach that may affect both investor sentiment and the company's revenue trajectory. The news could influence the efficiency of Humana's expanded clinical initiatives, which includes an enhanced use of AI and strategic acquisitions aimed at boosting patient care and operational scalability. With revenue currently standing at $117.76 billion and earnings at $1.21 billion, the company's investment in technology and primary care could drive potential margins if managed efficiently.

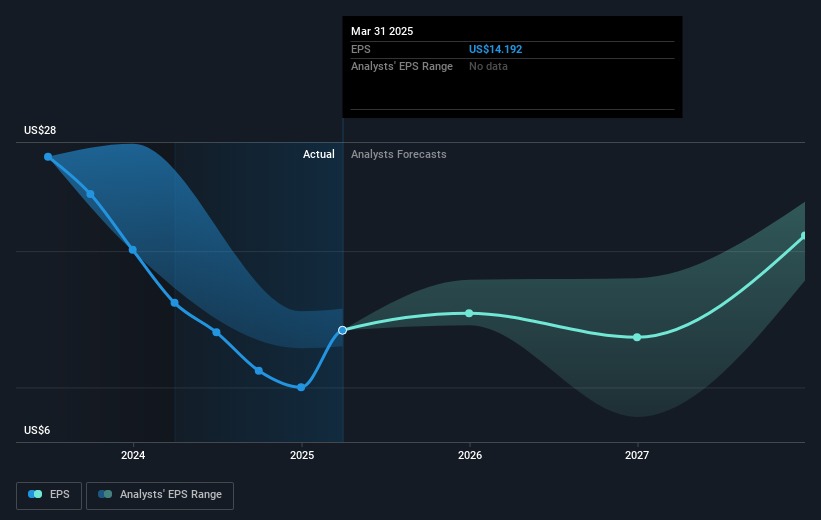

Over the past year, Humana experienced a total shareholder return decline of 15.53%, which contrasts with the broader market's gains driven by the tech sector. Compared to the US healthcare industry's 8% decline in the same period, Humana underperformed, highlighting challenges in aligning with industry trends. Looking forward, analysts project that Humana's revenue could grow at a rate of 5.6% annually, although earnings projections remain varied, ranging from $2.1 billion to $3.3 billion by 2028. Importantly, despite a current share price of US$259.36, the consensus price target of US$307.01 indicates an anticipated increase of 15.5%, suggesting potential for price appreciation if earnings growth targets are met.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English