Sprouts Farmers Market (NasdaqGS:SFM) Reports Strong Q1 Growth With Positive 2025 Guidance

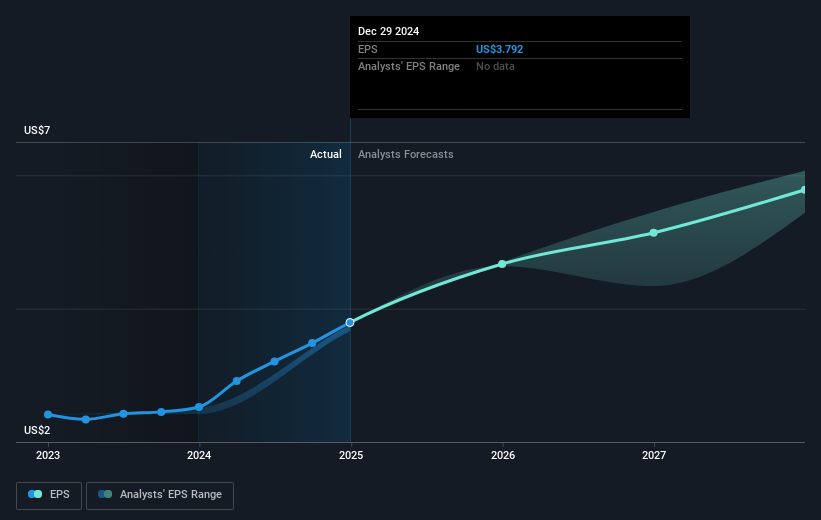

Sprouts Farmers Market (NasdaqGS:SFM) recently reported strong growth in sales and net income for Q1 2025, showing a net income increase to $180 million and basic EPS of $1.83. Coupled with optimistic guidance for the rest of the year, these events likely supported the company's 12% share price increase last month. This ascent aligns with broader market trends as the S&P 500 and Dow have extended winning streaks, supported by robust earnings from major tech companies. Sprouts' solid quarterly performance and future outlook likely added to the positive momentum seen in wider market movements.

You should learn about the 1 risk we've spotted with Sprouts Farmers Market.

The recent news about Sprouts Farmers Market's Q1 2025 performance and future store openings holds significant implications for its forecasted revenue and earnings growth. The planned expansion of 35 new stores into the Midwest and Northeast regions is likely to increase market reach, potentially boosting future revenues. The new loyalty program could enhance customer retention and elevate average spending, thereby positively affecting long-term earnings.

Over the past five years, the company's total return, incorporating both share price appreciation and dividends, was very large. This substantial increase in shareholder value indicates robust performance compared to the current one-year metrics, where Sprouts Farmers Market's performance exceeded both its industry and the broader US market returns. In the recent year, its shares outperformed the US Consumer Retailing industry with a 47.1% earnings growth, compared to an industry average of 3.6%.

The recent share price climb of 12% is closer to the analyst consensus price target of US$174.31, representing a discount of just 1.2% from the current price of US$172.3. This suggests that the market has a relatively optimistic outlook on Sprouts, aligning closely with analyst expectations. However, it’s essential for investors to consider the potential risks such as supply chain uncertainties and operational costs that could impact future gross margins and overall earnings growth assumptions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English