XPeng (NYSE:XPEV) Achieves 273% YoY Increase In April Smart EV Deliveries

XPeng (NYSE:XPEV) has showcased remarkable growth, delivering 35,045 Smart EVs in April 2025 with a 273% year-over-year increase. During the past quarter, which saw a 19% rise in its stock price, XPeng's strong sales figures for the first four months, amounting to 129,053 units delivered and reflecting a 313% yearly increase, emphasized its market momentum. This positive performance aligns with the broader market's upswing, marked by gains in major indices influenced by solid earnings reports from tech giants. XPeng's expansion into new markets also supported its stock price, counterbalancing broader economic concerns.

We've spotted 1 possible red flag for XPeng you should be aware of.

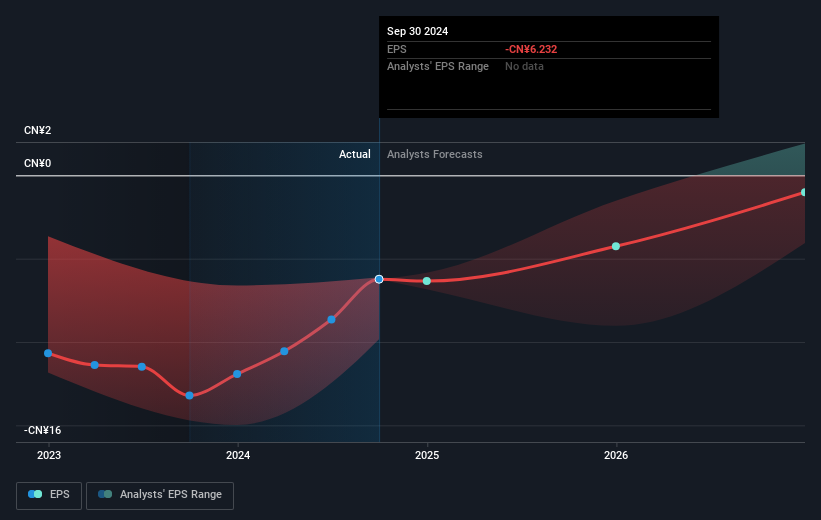

The impressive growth in XPeng's vehicle deliveries and a significant spike in stock price highlight a positive trajectory for the company. Yet, the intensified investments in AI and global expansion present challenges. While increased R&D and expansion efforts may compress short-term margins, they offer potential for future revenue enhancement. XPeng's focus on AI technologies, including AI-powered vehicles, suggests potential revenue increases but may delay short-term profitability.

Over the extended past year, XPeng shares achieved a total return of 129.06%. This contrasts with its one-year performance against the US Auto industry, which saw a return of 42.8%. With the current share price standing at US$22.64, XPeng's valuation is poised above the consensus analyst target of US$19.91, despite analysts foreseeing business improvements. This may indicate elevated market expectations.

The ongoing expansion into international markets and continuous AI-related initiatives could support revenue growth, with analysts forecasting a 33% annual increase over the next three years. However, with earnings still in the negative at CN¥5.79 billion, potential profitability in the future poses a challenge. The anticipated revenue of CN¥96.2 billion by March 2028 must be considered alongside such enhanced expectations and market pressures.

Dive into the specifics of XPeng here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English