Michael Saylor Considers Competition Copying Strategy's Bitcoin Playbook Mutually Beneficial: 'The More Companies That Join, The Better It Is'

Strategy Inc. (NASDAQ:MSTR) executive chairman Michael Saylor expressed optimism about the growing adoption of the Bitcoin standard among businesses on Thursday.

What Happened: During the company’s first-quarter earnings call, Saylor described the growing trend of companies buying Bitcoin (CRYPTO: BTC) for their treasury as a “virtuous cycle” and a “mutually beneficial competition.”

Saylor was asked about his views on other corporations aping Strategy’s playbook and how the firm aimed to retain its pioneering status in this area.

“The more companies that adopt the Bitcoin standard, the more legitimizing it is,” Saylor said. “As more companies adopt the Bitcoin standard, they're out there educating equity investors, and that brings more equity capital to the market.

See Also: Shiba Inu Burn Rate Skyrockets 2,094%: What Is Going On?

The Bitcoin bull stressed that the entry of more companies will make investors more comfortable investing in the space.

“So I think the more companies that join, the better it is for Bitcoin,” Saylor noted. He anticipated that this would hasten the transition to the Bitcoin standard, pressuring companies that have not yet adopted to do so over time.

Why It Matters: Strategy has outpaced the rest of the market in Bitcoin adoption, actively issuing convertible debt and other fixed-income products to add the top cryptocurrency to its reserves. As of this writing,

Following in its footsteps, big Bitcoin miners like Mara Holdings Inc. (NASDAQ:MARA) and Riot Platforms Inc. (NASDAQ:RIOT) began hoarding Bitcoin, employing similar stock offerings. According to BitcoinTreasuries.com, MicroStrategy was the largest Bitcoin corporate holder, with a stash worth more than $53.72 billion, followed by MARA and Riot.

Strategy reported financial results for the first quarter on Thursday after the bell, with revenue missing analyst estimates and an adjusted loss of $16.53 per share.

Price Action: At the time of writing, Bitcoin was exchanging hands at $96,982.25, up 2.29% in the last 24 hours, according to data from Benzinga Pro.

Shares of Strategy were down 0.81% in after-hours trading after closing 0.39% higher at $381.60 during Thursday’s regular session.

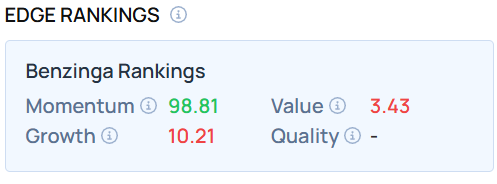

MSTR demonstrated a very high momentum score—a measure of the stock’s relative strength based on its price movement patterns and volatility over multiple timeframes—as of this writing. To find out how other Bitcoin-hoarding companies stack up, visit Benzinga Edge Stock Rankings.

Shutterstock: Yalcin Sonat

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English