Virginia National Bankshares And 2 Other Prominent Dividend Stocks

The U.S. stock market is currently experiencing a surge, with the S&P 500 on track for its longest winning streak since 2004, buoyed by strong employment data and potential trade talks with China. Amidst this backdrop of optimism and volatility, investors often turn to dividend stocks as a source of steady income and potential stability in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 4.94% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 6.26% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.88% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.39% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.05% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.62% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.02% | ★★★★★★ |

| Valley National Bancorp (NasdaqGS:VLY) | 5.05% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.24% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.60% | ★★★★★☆ |

Click here to see the full list of 155 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Virginia National Bankshares (NasdaqCM:VABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Virginia National Bankshares Corporation, with a market cap of $198.32 million, operates as the holding company for Virginia National Bank, offering a variety of commercial and retail banking services.

Operations: Virginia National Bankshares Corporation generates its revenue through a diverse array of commercial and retail banking services.

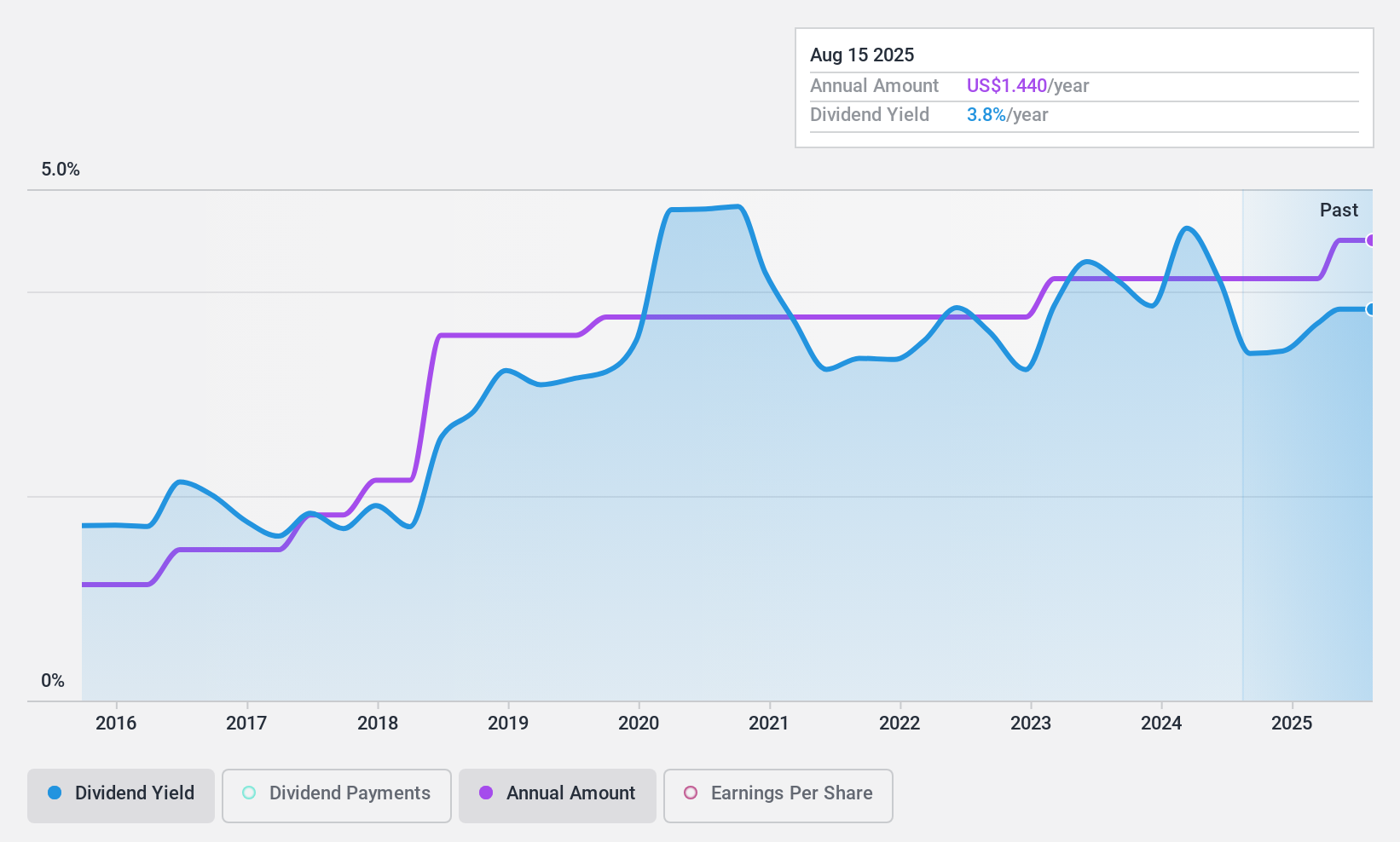

Dividend Yield: 4%

Virginia National Bankshares has demonstrated a stable and growing dividend over the past decade, with recent increases reflecting strong financial health. The latest quarterly dividend of US$0.36 per share marks a 9.1% increase, yielding approximately 4.09%. Despite trading below estimated fair value, its dividend yield remains below the top tier in the US market. Earnings have grown at an annual rate of 20.1% over five years, supporting a low payout ratio of 39.8%, indicating dividends are well covered by earnings.

- Dive into the specifics of Virginia National Bankshares here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Virginia National Bankshares is priced lower than what may be justified by its financials.

Lakeland Financial (NasdaqGS:LKFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lakeland Financial Corporation, with a market cap of $1.42 billion, operates as the bank holding company for Lake City Bank, offering a range of banking products and services in the United States.

Operations: Lakeland Financial Corporation generates revenue through its role as the bank holding company for Lake City Bank, providing a variety of banking products and services in the U.S.

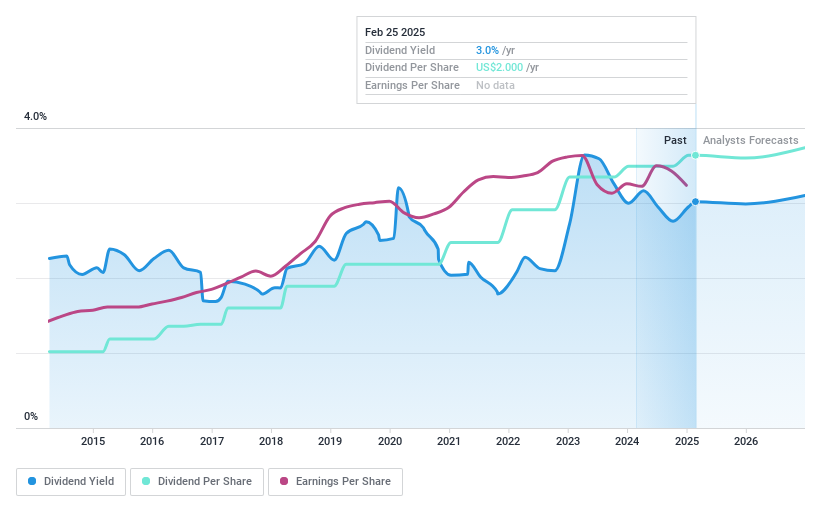

Dividend Yield: 3.6%

Lakeland Financial's dividend payments have shown stability and growth over the past decade, with a current quarterly dividend of US$0.50 per share. Despite trading 40.5% below estimated fair value, its 3.56% yield is not among the highest in the US market. The company's payout ratio of 55.8% indicates dividends are covered by earnings, although recent earnings showed a decline in net income to US$20.09 million for Q1 2025 from US$23.4 million a year ago.

- Unlock comprehensive insights into our analysis of Lakeland Financial stock in this dividend report.

- Our valuation report unveils the possibility Lakeland Financial's shares may be trading at a premium.

General American Investors Company (NYSE:GAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: General American Investors Company, Inc. is a publicly owned investment manager with a market cap of $1.19 billion.

Operations: General American Investors Company, Inc. generates its revenue from financial services through closed-end funds, amounting to $28.40 million.

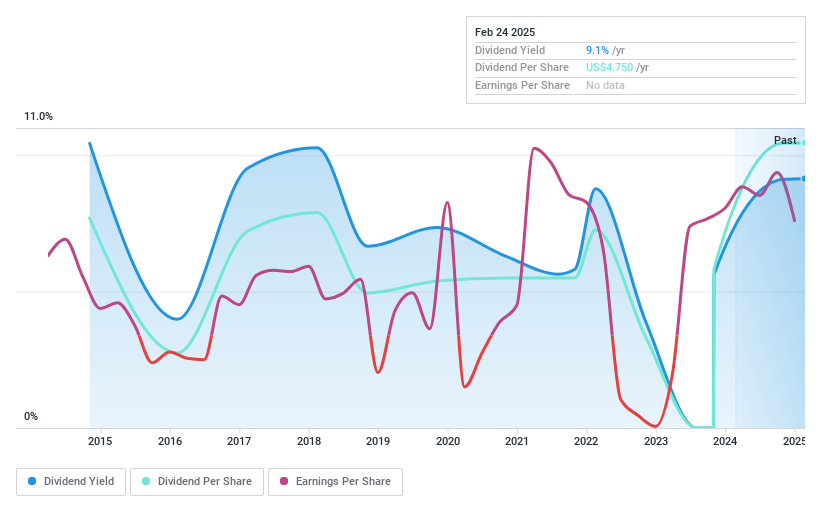

Dividend Yield: 9.3%

General American Investors Company offers a high dividend yield of 9.29%, placing it in the top 25% of US dividend payers, with a payout ratio of 47.6% indicating coverage by earnings. However, its dividends have been volatile over the past decade, raising concerns about reliability and sustainability. Recent actions include a special capital gain distribution and an expanded share buyback plan to 21.6 million shares, reflecting strategic financial management amidst fluctuating dividend stability.

- Click to explore a detailed breakdown of our findings in General American Investors Company's dividend report.

- In light of our recent valuation report, it seems possible that General American Investors Company is trading behind its estimated value.

Taking Advantage

- Take a closer look at our Top US Dividend Stocks list of 155 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English