NPK International Inc. (NYSE:NPKI) Shares Fly 50% But Investors Aren't Buying For Growth

NPK International Inc. (NYSE:NPKI) shareholders would be excited to see that the share price has had a great month, posting a 50% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 6.9% isn't as attractive.

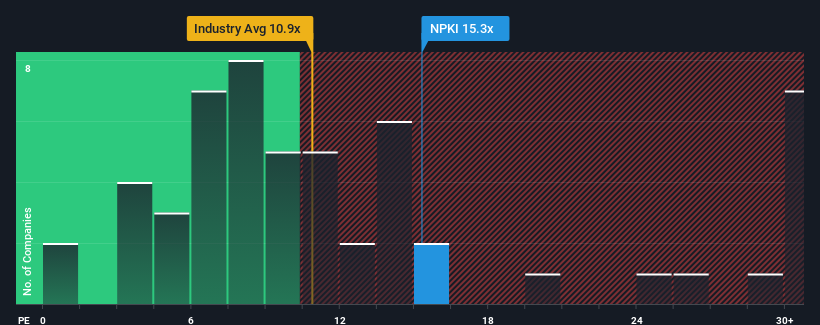

Even after such a large jump in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may still consider NPK International as an attractive investment with its 15.3x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 1 warning sign investors should be aware of before investing in NPK International. Read for free now.Recent times have been advantageous for NPK International as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for NPK International

How Is NPK International's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as NPK International's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 157%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 13% during the coming year according to the four analysts following the company. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

With this information, we are not surprised that NPK International is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

The latest share price surge wasn't enough to lift NPK International's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of NPK International's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for NPK International you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English