Expert Outlook: Cable One Through The Eyes Of 4 Analysts

In the latest quarter, 4 analysts provided ratings for Cable One (NYSE:CABO), showcasing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 2 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 1 | 0 |

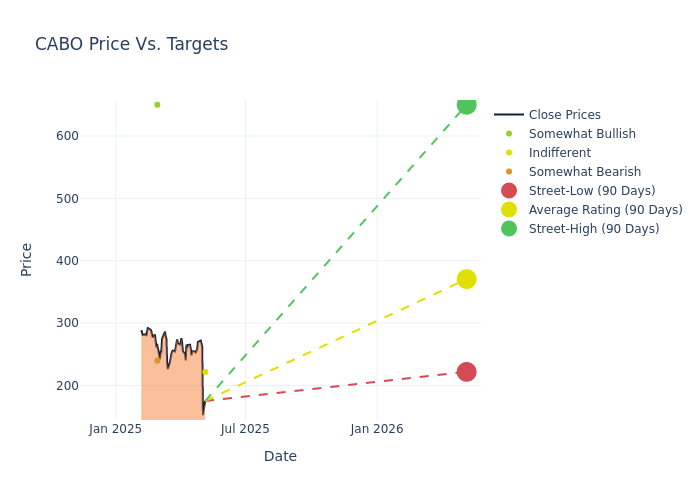

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $359.25, with a high estimate of $650.00 and a low estimate of $222.00. Observing a downward trend, the current average is 24.76% lower than the prior average price target of $477.50.

Decoding Analyst Ratings: A Detailed Look

A clear picture of Cable One's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Sebastiano Petti | JP Morgan | Lowers | Neutral | $222.00 | $325.00 |

| Sebastiano Petti | JP Morgan | Lowers | Neutral | $325.00 | $420.00 |

| Steven Cahall | Wells Fargo | Lowers | Underweight | $240.00 | $340.00 |

| Brandon Nispel | Keybanc | Lowers | Overweight | $650.00 | $825.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Cable One. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Cable One compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Cable One's stock. This analysis reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Cable One's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Cable One analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Cable One Better

Cable One Inc. is a telecommunications company that generates revenue from providing broadband, voice, and video services to both residential and business customers. From a product standpoint, the majority of revenue comes from data and video services, which are subscription-based and billed monthly. The company also offers Sparklight TV, an Internet Protocol Television (IPTV) service that enables customers using the Sparklight TV app to stream video channels from the cloud. Additionally, the company earns advertising revenue by selling airtime on its video channels, and it provides voice services over Internet protocols. Cable One Inc. owns its telecommunications infrastructure.

Unraveling the Financial Story of Cable One

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, Cable One faced challenges, resulting in a decline of approximately -5.86% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Communication Services sector.

Net Margin: Cable One's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 0.69%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Cable One's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 0.15%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Cable One's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.04%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 2.0, Cable One adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English