Moody's (NYSE:MCO) Enhances Flood Data Integration With Willis' Risk Management Tools

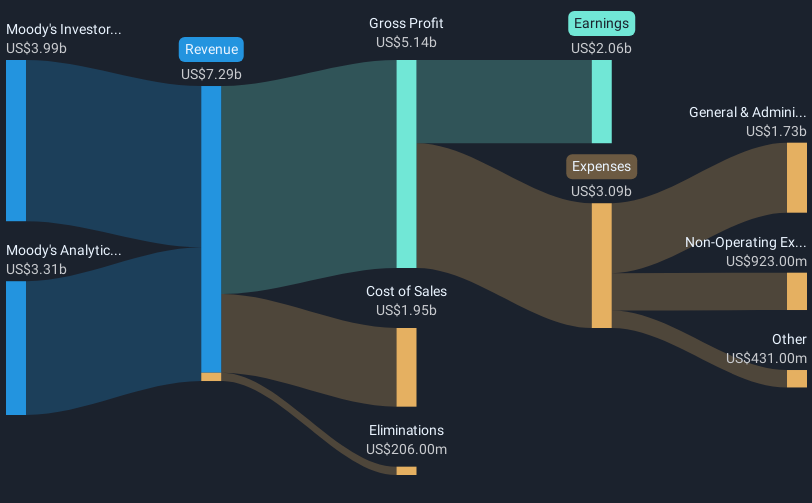

Moody's (NYSE:MCO) recent integration with Willis Towers Watson of its global flood data into risk management tools marks a key development in expanding partnership synergies. Over the past month, Moody's stock experienced a 15% rise, aligning with market trends where indices have generally moved upwards. The company's Q1 earnings report, which showed an increase in sales and net income, along with strategic moves like dividend affirmations and share buybacks, have added weight to this positive movement. Despite a broader market awaiting tariff and Fed updates, Moody's performance reflects resilience amid momentum across sectors.

You should learn about the 2 warning signs we've spotted with Moody's.

The recent integration of Moody's flood data into risk management tools with Willis Towers Watson is set to potentially influence the firm's revenue and earnings forecasts positively. This strategic partnership is positioned to enhance Moody's capability in offering precise risk assessments, especially crucial for private credit applications. The successful implementation could fortify revenue streams in Structured Finance and bolster earnings by driving demand for Moody's assessment services.

Over the past five years, Moody's shares have provided a total return of 91.55%, which includes dividends. This figure underscores robust long-term growth, contrasting with a more tempered performance trend in the last year. In the context of the broader market, Moody's return over the past year matched the US Capital Markets industry, which recorded a 19.4% increase, while surpassing the US Market's return of 8.2% over the same period.

Despite the recent share price rise and analyst consensus price target of US$500.92, representing approximately a 10.8% potential upside from the current US$447.00 price, caution is warranted. The current Price-to-Earnings (PE) Ratio of 39.7x underscores perceived overvaluation compared to industry and peer averages. The news of integration with Willis Towers Watson could help justify such valuations if ensuing revenue and margin enhancements align with forecasts. However, ongoing economic uncertainties present risks to maintaining this trajectory.

Take a closer look at Moody's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English