Tradeweb Markets (NasdaqGS:TW) Reports April Trading Volume of US$57.8 Trillion

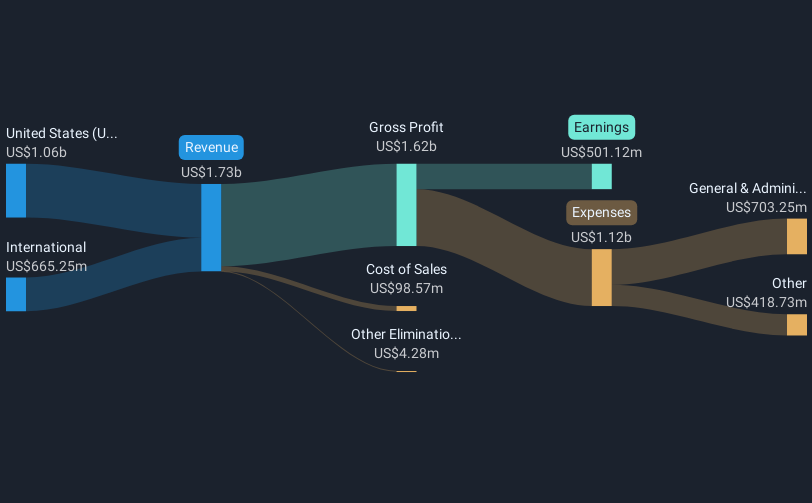

Tradeweb Markets (NasdaqGS:TW) reported a total trading volume of $57.8 trillion for April 2025, and its average daily volume surged by 38% year-over-year, highlighting significant operational growth. During the last quarter, the company saw a share price increase of 15%, reflecting this robust performance despite broader market fluctuations. Earnings results showed revenue and net income improvements, which, along with a 20% dividend increase, added positive pressure. In contrast, market volatility was observed with investor concerns over potential tariff impacts and Federal Reserve decisions, but Tradeweb's company-specific factors provided strong support against this uncertain backdrop.

The recent significant increase in Tradeweb Markets' trading volume and average daily volume underlines operational efficiencies and growth potential, reinforcing their strategic moves into new markets like Saudi Arabia and advancements in automation technology with AiEX. With a total shareholder return of 145.96% over five years, the company's longer-term performance demonstrates considerable appreciation in value, contrasting with shorter-term market fluctuations where it outperformed both the US Capital Markets industry and the broader market in the past year.

By leveraging these growth strategies, the revenue and earnings projections appear promising, with analysts forecasting substantial increases over the next few years. The recent share price rise of 15% in the last quarter, combined with a 20% dividend hike, highlights investor confidence, though it should be noted that the share price is still trading close to the consensus analyst price target of US$149.53. Given the current share price of US$137.38, the minimal gap to the target suggests that analysts collectively view the stock as fairly priced, underscoring the need for investors to critically evaluate these assumptions.

Assess Tradeweb Markets' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English