SIGN UP

LOG IN

Top 3 Health Care Stocks That Could Sink Your Portfolio In Q2

Benzinga·05/08/2025 12:00:53

Listen to the news

As of May 8, 2025, three stocks in the health care sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Clover Health Investments Corp (NASDAQ:CLOV)

- On May 6, the Medicare Advantage-focused insurtech company reported quarterly sales of $462.33 million, up 33% year-over-year but below the consensus estimate of $499.56 million. “I am very pleased with our strong start to the year, demonstrating our ability to meaningfully grow membership and expand profitability,” said Clover Health CEO Andrew Toy. The company's stock jumped around 9% over the past five days and has a 52-week high of $4.86.

- RSI Value: 71.2

- CLOV Price Action: Shares of Clover Health Investments gained 12.5% to close at $3.77 on Wednesday.

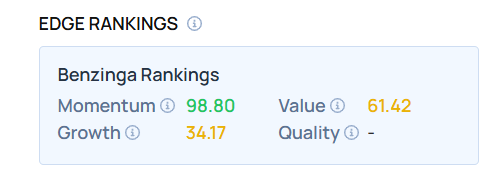

- Edge Stock Ratings: 98.90 Momentum score with Value at 61.42.

Ardent Health Partners Inc (NYSE:ARDT)

- On May 6, Ardent Health Partners reported better-than-expected first-quarter EPS results. “Ardent delivered solid first quarter 2025 results that reflect the successful execution of our strategic priorities and put us on track to meet our full-year financial targets,” stated Marty Bonick, President and Chief Executive Officer of Ardent Health. The company's stock gained around 20% over the past month and has a 52-week high of $20.72.

- RSI Value: 73

- ARDT Price Action: Shares of Ardent Health Partners gained 9.2% to close at $14.21 on Wednesday.

Hims & Hers Health Inc (NYSE:HIMS)

- On May 5, Hims & Hers Health reported first-quarter revenue of $586.01 million, beating estimates of $538.2 million, according to Benzinga Pro. The company reported first-quarter earnings of 20 cents per share, beating analyst estimates of 12 cents per share. "We're starting 2025 with incredible momentum. Millions of people are turning to us for access to care that is personal, affordable, and has the potential to drive better outcomes," said Andrew Dudum, co-founder and CEO of Hims & Hers Health. The company's stock gained around 101% over the past month and has a 52-week high of $72.98.

- RSI Value: 79.1

- HIMS Price Action: Shares of Hims & Hers Health gained 5.8% to close at $52.35 on Wednesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Risk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.