Peabody Energy (NYSE:BTU) Has Affirmed Its Dividend Of $0.075

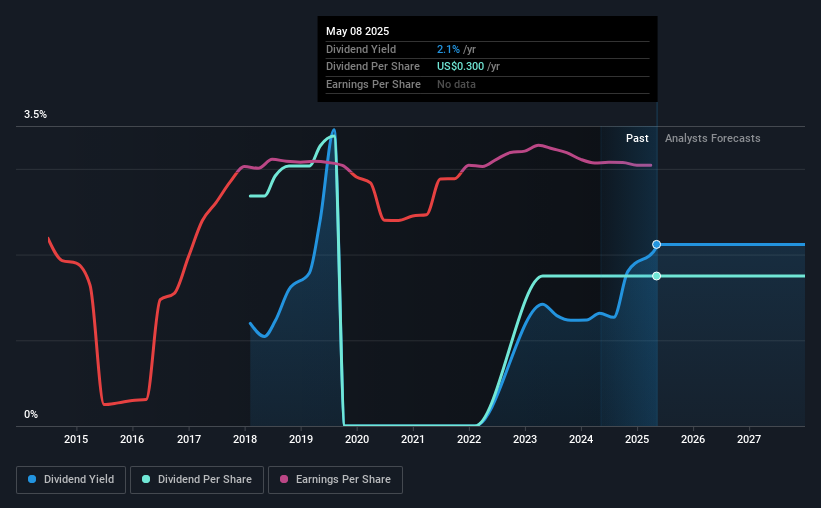

The board of Peabody Energy Corporation (NYSE:BTU) has announced that it will pay a dividend of $0.075 per share on the 4th of June. Including this payment, the dividend yield on the stock will be 2.1%, which is a modest boost for shareholders' returns.

Our free stock report includes 3 warning signs investors should be aware of before investing in Peabody Energy. Read for free now.Peabody Energy's Future Dividend Projections Appear Well Covered By Earnings

Even a low dividend yield can be attractive if it is sustained for years on end. However, prior to this announcement, Peabody Energy's dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS is forecast to fall by 27.1%. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 10.0%, which is comfortable for the company to continue in the future.

See our latest analysis for Peabody Energy

Peabody Energy's Dividend Has Lacked Consistency

It's comforting to see that Peabody Energy has been paying a dividend for a number of years now, however it has been cut at least once in that time. This suggests that the dividend might not be the most reliable. The annual payment during the last 7 years was $0.46 in 2018, and the most recent fiscal year payment was $0.30. This works out to be a decline of approximately 5.9% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. We are encouraged to see that Peabody Energy has grown earnings per share at 58% per year over the past five years. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

We Really Like Peabody Energy's Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. However, it is worth noting that the earnings are expected to fall over the next year, which may not change the long term outlook, but could affect the dividend payment in the next 12 months. Taking this all into consideration, this looks like it could be a good dividend opportunity.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 3 warning signs for Peabody Energy you should be aware of, and 1 of them is significant. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English