These Analysts Revise Their Forecasts On Allegro MicroSystems After Q4 Results

Allegro MicroSystems, Inc. (NASDAQ:ALGM) reported better-than-expected fourth-quarter financial results and issued first-quarter sales guidance above estimates.

Allegro Microsystems posted adjusted earnings of 6 cents per share, beating market estimates of 5 cents per share. The company's quarterly sales came in at $192.82 million versus expectations of $185.28 million.

“During the fourth quarter, we delivered on our commitments with sales of $193 million, up 8% sequentially, and non-GAAP EPS of $0.06,” said Mike Doogue, President and CEO of Allegro. “While the environment remains dynamic, we are encouraged by the positive momentum we are seeing across the business and the signals we are seeing from our customers. We are taking actions to accelerate growth in strategic focus areas, secure important customer wins and drive operating efficiencies, while improving profitability. As Allegro’s CEO, I am excited to leverage the breadth and depth of my experience to help accelerate our path toward our target financial model and unlock additional shareholder value.”

Allegro Microsystems said it sees first-quarter adjusted earnings of 6 cents to 10 cents per share on sales of $192.00 million to $202.00 million.

Allegro MicroSystems shares gained 12.7% to close at $21.07 on Thursday.

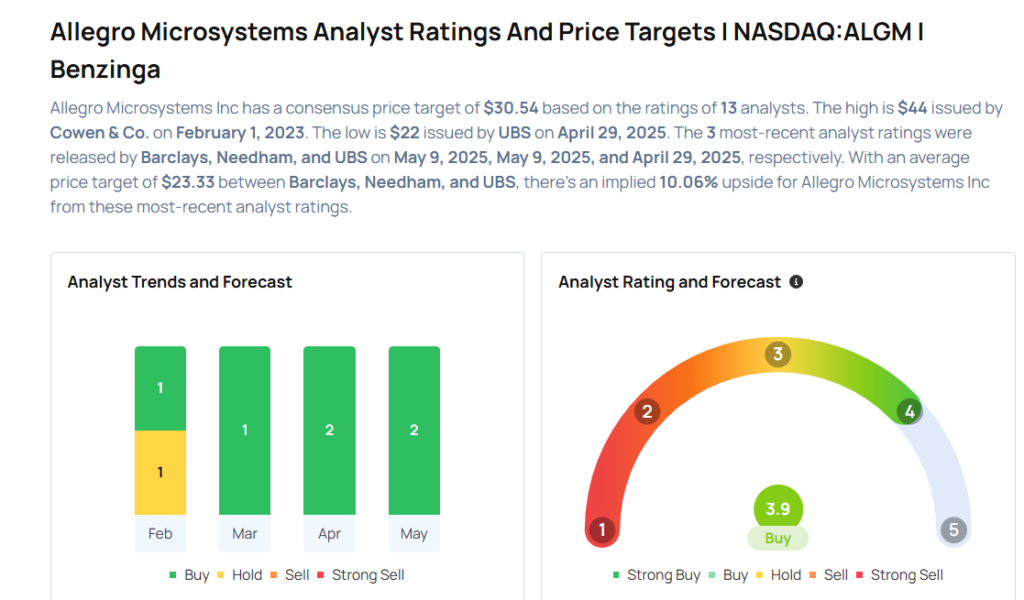

These analysts made changes to their price targets on Allegro MicroSystems following earnings announcement.

- Needham analyst Quinn Bolton maintained Allegro Microsystems with a Buy and lowered the price target from $30 to $25.

- Barclays analyst Blayne Curtis maintained the stock with an Overweight rating and raised the price target from $22 to $23.

Considering buying ALGM stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English