Best Momentum Stocks to Buy for May 9th

Here are three stocks with buy rank and strong momentum characteristics for investors to consider today, May 9th:

BioCryst Pharmaceuticals, Inc. BCRX: This biotechnology company has a Zacks Rank #1 and witnessed the Zacks Consensus Estimate for its current year earnings increasing 285.7% over the last 60 days.

BioCryst’s shares gained 15% over the last three months compared with the S&P 500’s decline of 7.2%. The company possesses a Momentum Score of A.

WidePoint Corporation WYY: This company that provides technology management as a service (TMaaS) has a Zacks Rank #1 and witnessed the Zacks Consensus Estimate for its current year earnings increasing 108.3% overthe last 60 days.

WidePoint’s shares gained 35.7% over the last three months compared with the S&P 500’s decline of 7.2%. The company possesses a Momentum Score of B.

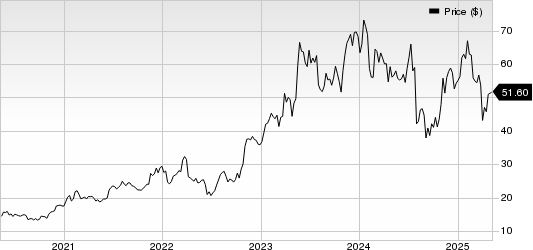

Rambus Inc. RMBS: This semiconductor products company has a Zacks Rank #1 and witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.9% overthe last 60 days.

Rambus’ shares gained 11.6% over the past month compared with the S&P 500’s advance of 6.9%. The company possesses a Momentum Score of B.

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BioCryst Pharmaceuticals, Inc. (BCRX): Free Stock Analysis Report

Rambus, Inc. (RMBS): Free Stock Analysis Report

WidePoint Corporation (WYY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English