Shoucheng Holdings' (HKG:697) Dividend Will Be Reduced To HK$0.0164

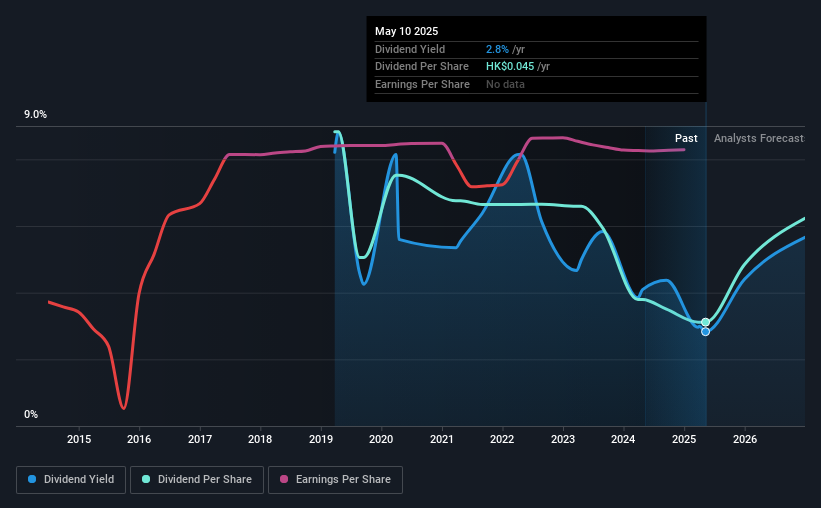

Shoucheng Holdings Limited (HKG:697) is reducing its dividend from last year's comparable payment to HK$0.0164 on the 7th of August. This payment takes the dividend yield to 2.8%, which only provides a modest boost to overall returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Shoucheng Holdings' stock price has increased by 36% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Shoucheng Holdings' Projected Earnings Seem Likely To Cover Future Distributions

If it is predictable over a long period, even low dividend yields can be attractive. Prior to this announcement, Shoucheng Holdings' dividend was making up a very large proportion of earnings and perhaps more concerning was that it was 168% of cash flows. Paying out such a high proportion of cash flows can expose the business to needing to cut the dividend if the business runs into some challenges.

Over the next year, EPS is forecast to expand by 103.9%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 58% which would be quite comfortable going to take the dividend forward.

Check out our latest analysis for Shoucheng Holdings

Shoucheng Holdings' Dividend Has Lacked Consistency

It's comforting to see that Shoucheng Holdings has been paying a dividend for a number of years now, however it has been cut at least once in that time. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The annual payment during the last 6 years was HK$0.128 in 2019, and the most recent fiscal year payment was HK$0.045. The dividend has fallen 65% over that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth May Be Hard To Come By

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Shoucheng Holdings has seen earnings per share falling at 7.5% per year over the last five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

The Dividend Could Prove To Be Unreliable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The track record isn't great, and the payments are a bit high to be considered sustainable. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Shoucheng Holdings that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English