Earnings Outlook For DoubleDown Interactive

DoubleDown Interactive (NASDAQ:DDI) will release its quarterly earnings report on Tuesday, 2025-05-13. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate DoubleDown Interactive to report an earnings per share (EPS) of $0.55.

Investors in DoubleDown Interactive are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

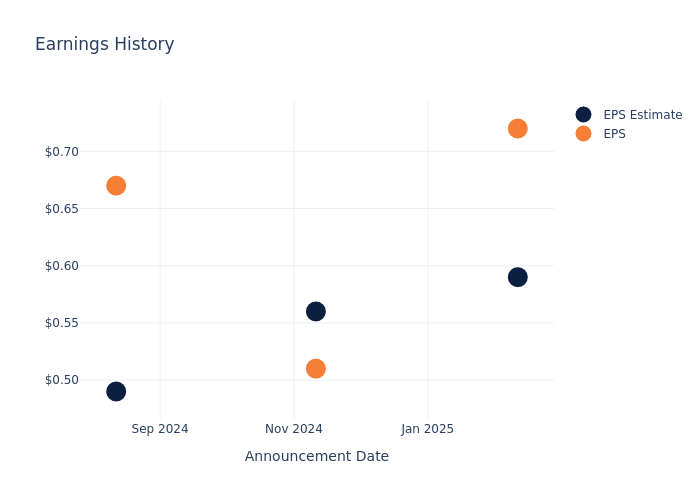

Historical Earnings Performance

The company's EPS beat by $0.13 in the last quarter, leading to a 7.31% drop in the share price on the following day.

Here's a look at DoubleDown Interactive's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.59 | 0.56 | 0.49 | 0.48 |

| EPS Actual | 0.72 | 0.51 | 0.67 | 0.61 |

| Price Change % | -7.000000000000001% | -5.0% | -1.0% | 9.0% |

Tracking DoubleDown Interactive's Stock Performance

Shares of DoubleDown Interactive were trading at $10.96 as of May 09. Over the last 52-week period, shares are up 0.97%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for DoubleDown Interactive visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English