Alnylam Pharmaceuticals (NasdaqGS:ALNY) To Present Pivotal TTR Franchise Data At Heart Failure Congress

In May 2025, Alnylam Pharmaceuticals (NasdaqGS:ALNY) announced its plan to present new data from its transthyretin amyloidosis (TTR) franchise at the Heart Failure 2025 Congress, alongside securing broader international approvals for its therapeutic vutrisiran (AMVUTTRA). During the same month, the overall market rallied due to positive developments in U.S.-China trade relations, with major indexes experiencing substantial gains. Alnylam's 5.63% rise over the period likely reflects investor optimism towards its recent product announcements and earnings improvements, aligning with broader market upward trends driven by eased international trade tensions.

Alnylam Pharmaceuticals has 1 warning sign we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

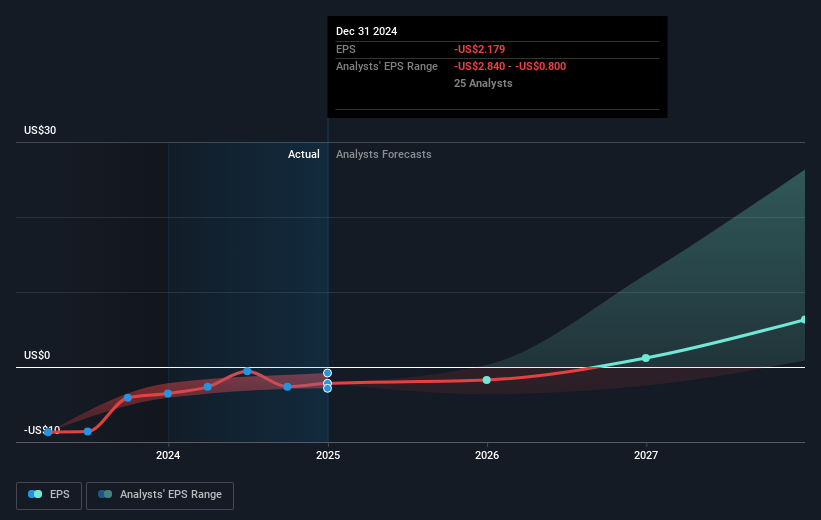

The recent announcement by Alnylam Pharmaceuticals about presenting new data at Heart Failure 2025 Congress and gaining wider international approvals for vutrisiran could significantly bolster investor confidence in the company's growth trajectory. Given the expanded indication for AMVUTTRA in ATTR cardiomyopathy, the potential for increased revenue is substantial. This aligns with the company's aim to achieve sustainable profitability, despite current earnings being at US$269.7 million. Additionally, analysts forecast future earnings to improve, with expected revenue reaching several billion dollars, indicating growth prospects fueled by new product launches and expanding market share.

Over the past three years, Alnylam's total shareholder return, including share price and dividends, was 101.13%. This robust performance compares favorably against the market's 8% return over the past year. Additionally, Alnylam outperformed the US Biotechs industry, which experienced a 15.3% decline in the same time frame. These figures underscore Alnylam's relative strength and investor optimism toward its pipeline and strategic initiatives.

The enthusiasm generated by Alnylam's recent developments is also reflected in the stock's price movement. The shares currently trade at a discount to the consensus analyst price target of US$320.56, suggesting potential upside if future earnings and revenue growth materialize as expected. However, despite the positive sentiment, the stock's price-to-sales ratio remains above both industry and peer averages, indicating a premium valuation. As such, the price movement in conjunction with analyst forecasts highlights both potential growth opportunities and the inherent risks associated with Alnylam's current market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English