SouthState Stock: A Deep Dive Into Analyst Perspectives (8 Ratings)

8 analysts have shared their evaluations of SouthState (NYSE:SSB) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 5 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 1 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

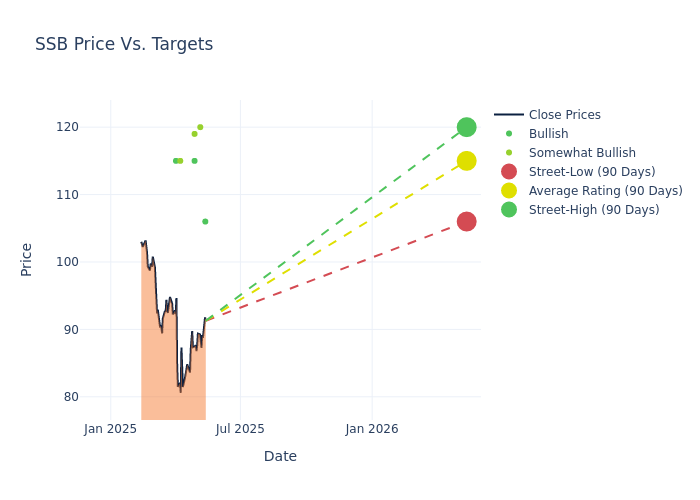

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $117.5, along with a high estimate of $130.00 and a low estimate of $106.00. A 5.24% drop is evident in the current average compared to the previous average price target of $124.00.

Deciphering Analyst Ratings: An In-Depth Analysis

An in-depth analysis of recent analyst actions unveils how financial experts perceive SouthState. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brandon King | Truist Securities | Announces | Buy | $106.00 | - |

| Catherine Mealor | Keefe, Bruyette & Woods | Lowers | Outperform | $120.00 | $130.00 |

| Gary Tenner | DA Davidson | Lowers | Buy | $115.00 | $125.00 |

| Russell Gunther | Stephens & Co. | Maintains | Overweight | $119.00 | $119.00 |

| Jared Shaw | Barclays | Lowers | Overweight | $115.00 | $120.00 |

| Michael Rose | Raymond James | Lowers | Strong Buy | $115.00 | $120.00 |

| Jared Shaw | Barclays | Announces | Overweight | $120.00 | - |

| Russell Gunther | Stephens & Co. | Maintains | Overweight | $130.00 | $130.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to SouthState. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of SouthState compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for SouthState's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of SouthState's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on SouthState analyst ratings.

Discovering SouthState: A Closer Look

SouthState Corp is a United States-based bank holding company. It provides a wide range of services and products to its customers through a wholly-owned bank subsidiary, South State Bank. The Bank provides retail and commercial banking services, mortgage lending services, trust and investment services, and consumer finance loans through financial centers in Alabama, Florida, Georgia, North Carolina, South Carolina, and Virginia. These services include demand, time and savings deposits, lending and credit card servicing, ATM processing, and wealth management and trust services.

Understanding the Numbers: SouthState's Finances

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: SouthState's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 51.78%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: SouthState's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 14.13%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.23%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): SouthState's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.16%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 0.09, SouthState adopts a prudent financial strategy, indicating a balanced approach to debt management.

How Are Analyst Ratings Determined?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English