Shenglong Splendecor International Limited's (HKG:8481) Shares Not Telling The Full Story

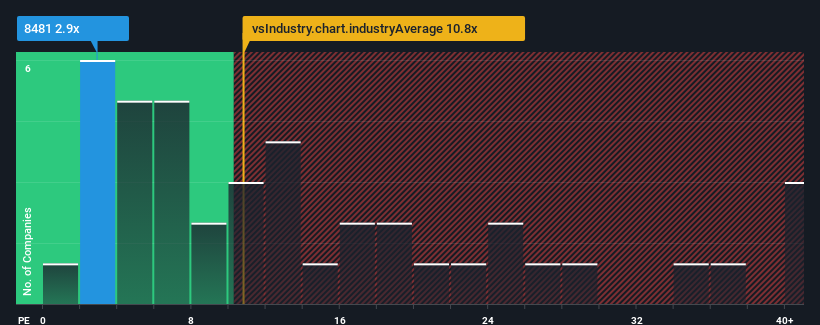

Shenglong Splendecor International Limited's (HKG:8481) price-to-earnings (or "P/E") ratio of 2.9x might make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 12x and even P/E's above 23x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 4 warning signs investors should be aware of before investing in Shenglong Splendecor International. Read for free now.Shenglong Splendecor International certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Shenglong Splendecor International

Is There Any Growth For Shenglong Splendecor International?

In order to justify its P/E ratio, Shenglong Splendecor International would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 74% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 288% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 18% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Shenglong Splendecor International's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Shenglong Splendecor International's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shenglong Splendecor International currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Shenglong Splendecor International (2 are concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Shenglong Splendecor International, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English