Teladoc Health (NYSE:TDOC) Reports Q1 2025 Net Loss Of US$93 Million

Teladoc Health (NYSE:TDOC) recently announced its first quarter results for 2025, reporting sales of $629 million and a net loss of $93 million. Amid these earnings announcements, the stock experienced a 12% price increase over the past week, outpacing the broader market's 4% rise. The goodwill impairment charge of $59 million reported by the company likely added weight to these movements, contrasting the overall market trend which showed a positive growth outlook. With the company's revenue guidance for Q2 and full year aligning closely with past performance, these elements have informed shareholder perspectives alongside market dynamics.

Teladoc Health has 1 warning sign we think you should know about.

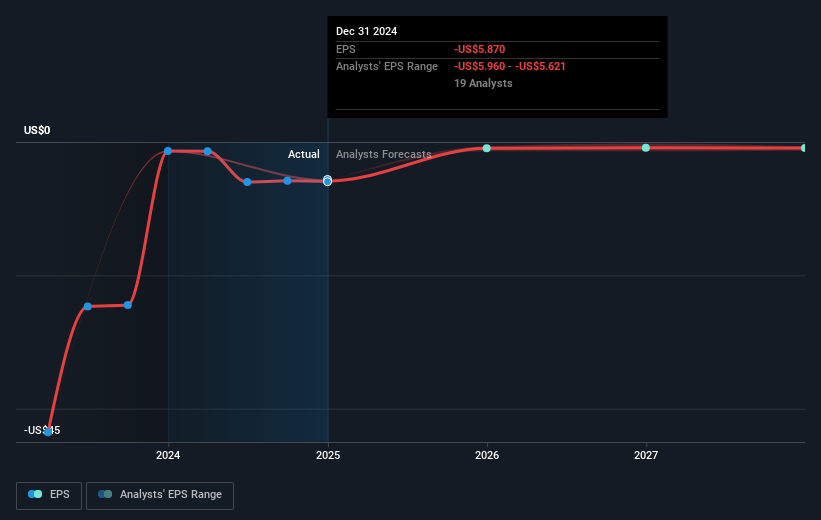

Teladoc Health's recent quarter results, with sales of US$629 million and a net loss of US$93 million, have driven a 12% weekly share price increase. This rise contrasts with the stock's longer-term performance, where Teladoc shares declined by 40.19% over the past year. This decline overshadows the broader US market and Healthcare Services industry one-year returns of 11.6% and 13.3% respectively. The goodwill impairment charge of US$59 million and aligned revenue guidance might suggest a steady path forward, influencing shareholder sentiment toward cautious optimism despite ongoing losses.

The earnings results, coupled with recent strategic moves such as the acquisition of Catapult Health, are likely to be pivotal in shaping revenue and earnings forecasts. The renewed focus on customer growth and technological enhancement could bolster future revenue streams, although immediate profitability remains elusive. The current momentum in share price reflects market expectations of these future benefits but remains below the analyst consensus price target of US$10.21, representing a 28.2% potential upside from today's share price of US$7.33. This highlights a significant gap that Teladoc needs to close by demonstrating concrete progress in revenue enhancements and margin improvements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English