DocuSign (NasdaqGS:DOCU) Appoints New Chief Information Security Officer

DocuSign (NasdaqGS:DOCU) recently launched the DocuSign CLM Connector for Coupa and appointed Michael Adams as the new Chief Information Security Officer. These updates coincide with the company experiencing a 22% share price increase last month. While these developments likely enhanced investor confidence, the company's price movement mirrors broader market trends, which have seen a 12% climb over the past year and a 4% increase in the last seven days. DocuSign's innovations and strategic leadership changes may have supported its ascent, harmonizing with the generally positive market momentum.

We've identified 2 risks for DocuSign that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

DocuSign's recent initiatives, including the launch of its CLM Connector for Coupa and Michael Adams' appointment as Chief Information Security Officer, could enhance operational capabilities and investor sentiment. Over the past year, the company's shares posted a total return of 51.25%, showcasing strength and potential resilience, especially compared to the broader market's 11.6% return. This indicates a strong rebound in DocuSign's stock, outpacing its industry peers, which recorded a 17.8% return over the same period.

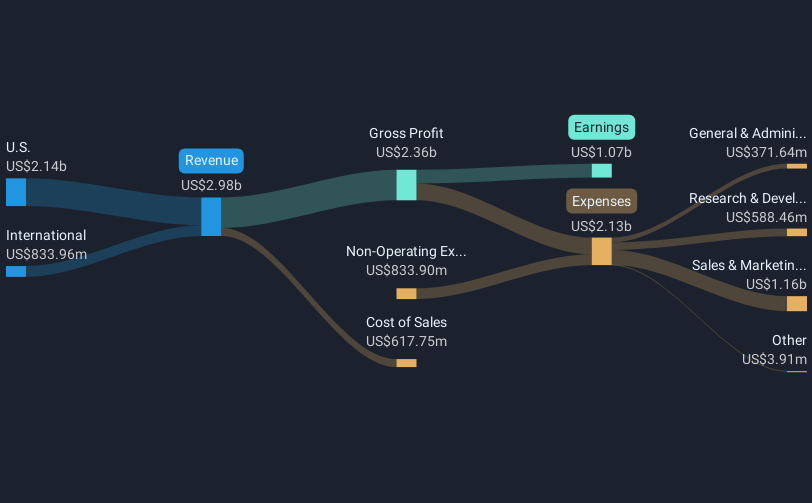

The introduction of Intelligent Agreement Management is anticipated to significantly impact revenue and earnings forecasts, as analysts expect international markets and SMB segments to see enhanced growth. However, projected challenges, such as fluctuating profit margins and operational impacts, remain a concern. With a current share price of US$81.65, closely aligned with but still 11% below the consensus price target of US$91.74, the potential for upward movement remains, reflecting cautious optimism among analysts. Investors are advised to keep a watchful eye on these developments and how they might alter future valuations and forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English