LKQ Corporation Stock: Is Wall Street Bullish or Bearish?

LKQ Corporation (LKQ) is a prominent global distributor of alternative and specialty automotive parts, headquartered in Tennessee. Founded in 1998, the company has expanded significantly through over 270 acquisitions, including notable names like Keystone Automotive, Euro Car Parts, and Rhiag-Inter Auto Parts, and is currently valued at a market cap of $10.8 billion.

LKQ has significantly underperformed the broader market over the past year. LKQ stock plunged 5.5% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 12.7% surge over the past year. However, the stock has shown impressive performance in 2025, rising 14.5%, outpacing $SPX’s marginal rise on a YTD basis.

Zooming in further, while LKQ has trailed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 21% gains over the past year, it has outpaced XLY’s 4% fall this year.

Shares of LKQ dropped 11.9% on Apr. 24, after the company reported disappointing Q1 2025 results. Revenue fell 6.5% year-over-year to $3.5 billion, with all business segments declining 5–7% due to weaker demand and limited pricing power. It posted an adjusted EPS of $0.79, a 3.7% decrease from Q1 2024, aligning with analyst expectations. The company also significantly missed its full-year EBITDA guidance, making it a notably soft quarter overall.

Analysts expect LKQ’s earnings to climb 1.7% year-over-year to $3.54 per share in the current year ending in December. However, the company has a mixed earnings surprise history as it beat or met the consensus estimates in three of the past four quarters, missing on another occasion.

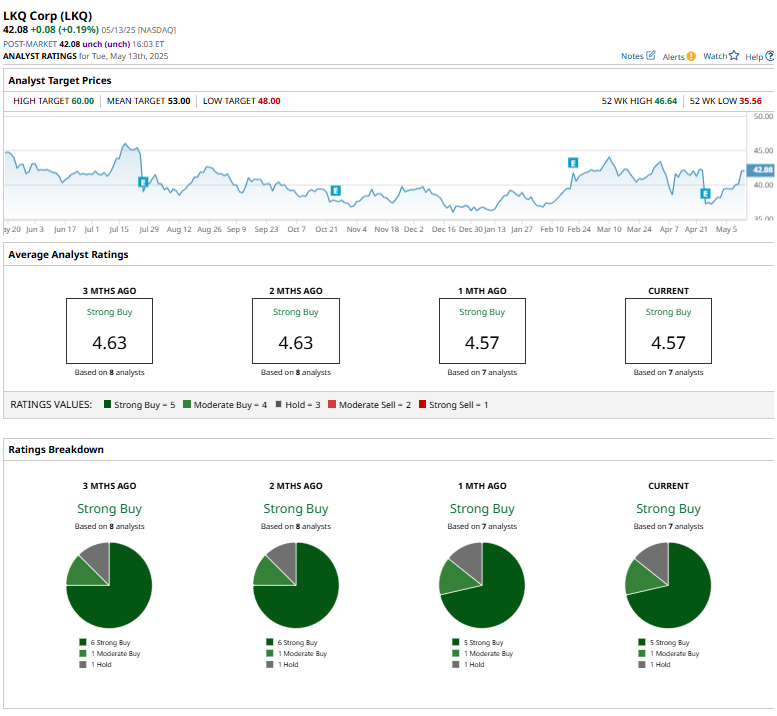

Among the seven analysts covering the LKQ stock, the consensus rating is a “Strong Buy.” That’s based on five “Strong Buy,” one “Moderate Buy,” and one “Hold” rating.

This configuration is less bullish than two months ago, when it had six “Strong Buy” suggestions.

On April 21, Barrington Research analyst Gary Prestopino reaffirmed his “Outperform” rating on LKQ and maintained a price target of $60, which is also the Street-high price target.

LKQ’s mean price target of $53 represents a 26% premium to current price levels, while its street-high target of $60 indicates a staggering 42.6% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English