Exploring Shoucheng Holdings And 2 Other Promising Small Caps In Asia

As global markets navigate a landscape of mixed economic signals and evolving trade dynamics, small- and mid-cap indexes have shown resilience, posting gains for the fifth consecutive week. In this context, Asia's small-cap sector presents intriguing opportunities as investors seek companies with strong fundamentals that can thrive amid the region's shifting economic backdrop.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CAC Holdings | 4.97% | 0.98% | 14.37% | ★★★★★★ |

| Ryoyu Systems | NA | 5.05% | 16.94% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 5.72% | 8.48% | ★★★★★★ |

| Natural Food International Holding | NA | 5.61% | 32.98% | ★★★★★★ |

| Mega Union Technology | 9.42% | 12.79% | 52.00% | ★★★★★★ |

| Kanro | NA | 6.67% | 37.24% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 45.53% | -12.49% | 10.72% | ★★★★★★ |

| Episil-Precision | 9.60% | 0.57% | 16.64% | ★★★★★★ |

| Uoriki | 0.19% | 3.73% | 10.97% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Shoucheng Holdings (SEHK:697)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shoucheng Holdings Limited is an investment holding company involved in the infrastructure asset management business, with a market capitalization of HK$12.53 billion.

Operations: Shoucheng Holdings generates revenue primarily from its infrastructure asset management business, reporting HK$1.22 billion in this segment.

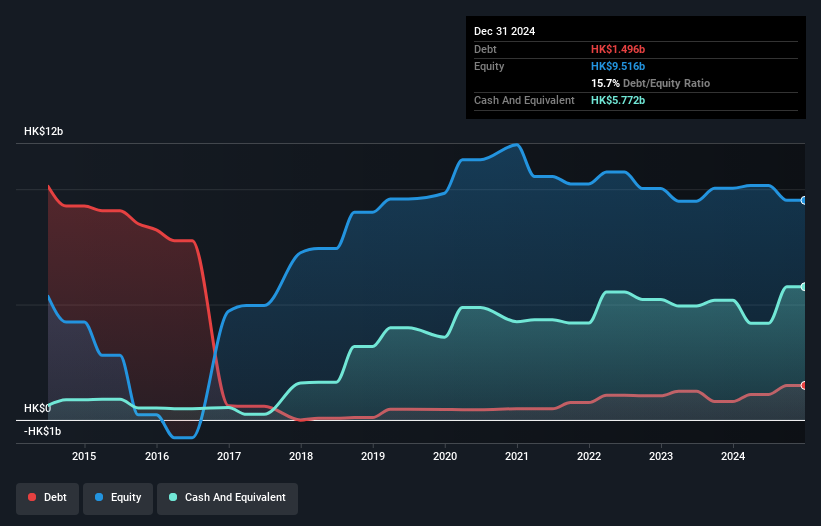

Shoucheng Holdings, a dynamic player in the market, has shown resilience with earnings growth of 1.6% over the past year, outpacing the real estate industry's -19.5%. The company's debt to equity ratio increased from 4.6% to 15.7% over five years, yet it holds more cash than total debt, indicating financial stability. Recent board changes and a special dividend of HKD 888 million reflect strategic adjustments and shareholder value focus. With earnings per share at HKD 0.0576, up from HKD 0.0557 last year, Shoucheng seems poised for continued growth amidst industry challenges.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Value Rating: ★★★★★★

Overview: Chenming Electronic Tech Corp. is an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and other international markets with a market cap of NT$21.64 billion.

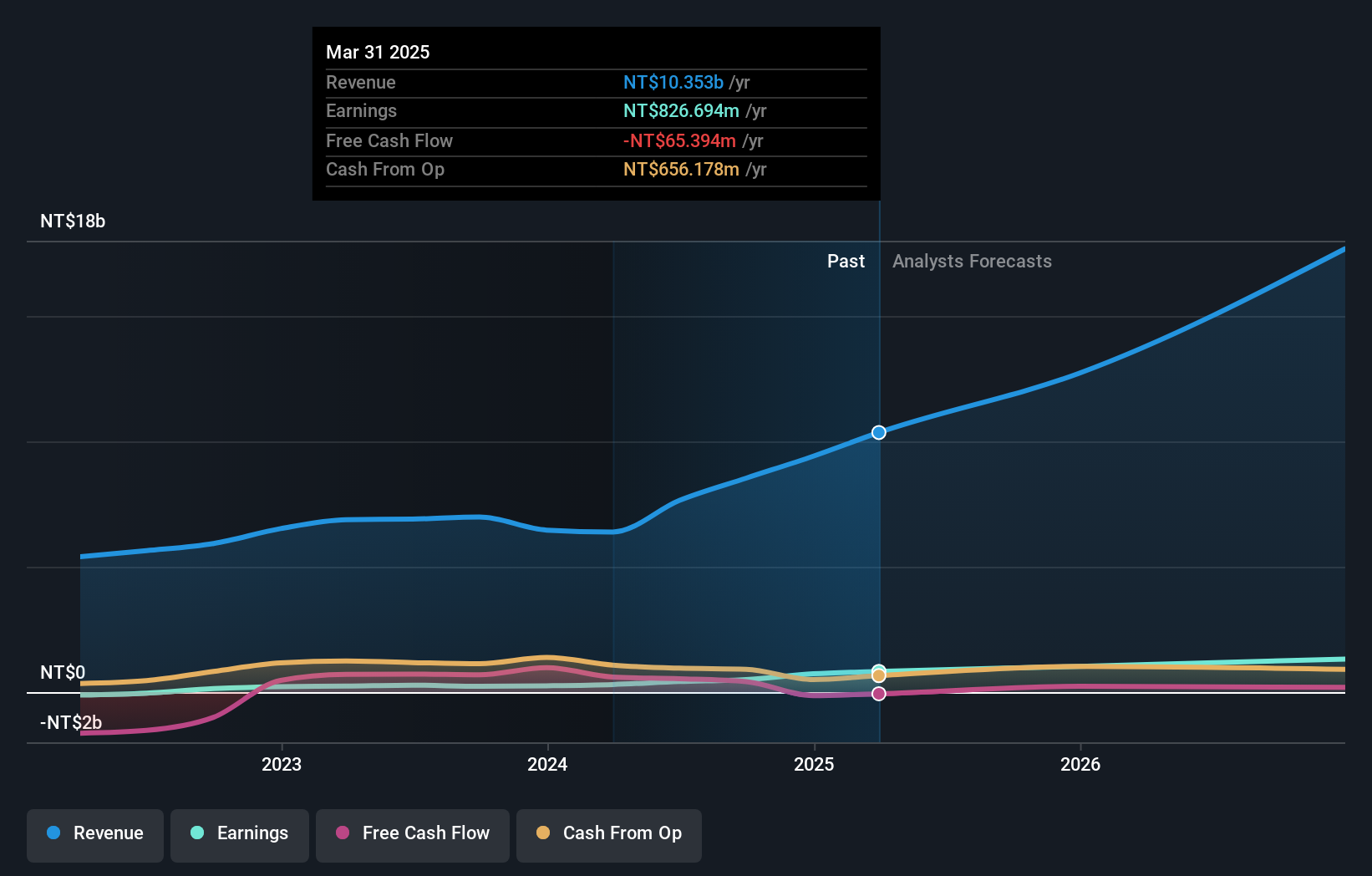

Operations: Chenming Electronic Tech generates revenue primarily from the production and sales of computer and mobile device components, amounting to NT$10.35 billion. The company's financial performance is characterized by its net profit margin, which provides insight into its profitability relative to total revenue.

Chenming Electronic Tech, a smaller player in the tech industry, has been turning heads with its impressive financial performance. Over the past year, earnings skyrocketed by 171.9%, outpacing the broader tech industry's growth of 15.3%. The company's debt to equity ratio improved significantly from 29.9% to 14.2% over five years, suggesting better financial health and management efficiency. Recent figures show sales for Q1 2025 reached TWD 2.4 billion compared to TWD 1.46 billion last year, while net income increased to TWD 172 million from TWD 76 million—a solid indicator of robust operational performance and strategic direction in a competitive market landscape.

- Unlock comprehensive insights into our analysis of Chenming Electronic Tech stock in this health report.

Evaluate Chenming Electronic Tech's historical performance by accessing our past performance report.

Chicony Power Technology (TWSE:6412)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chicony Power Technology Co., Ltd. is involved in the development, manufacturing, and sale of switching power supplies, electronic components and LED lighting modules, as well as smart building solutions in Taiwan, with a market capitalization of NT$43.48 billion.

Operations: Chicony Power Technology generates revenue through the sale of switching power supplies, electronic components, LED lighting modules, and smart building solutions. The company has a market capitalization of NT$43.48 billion.

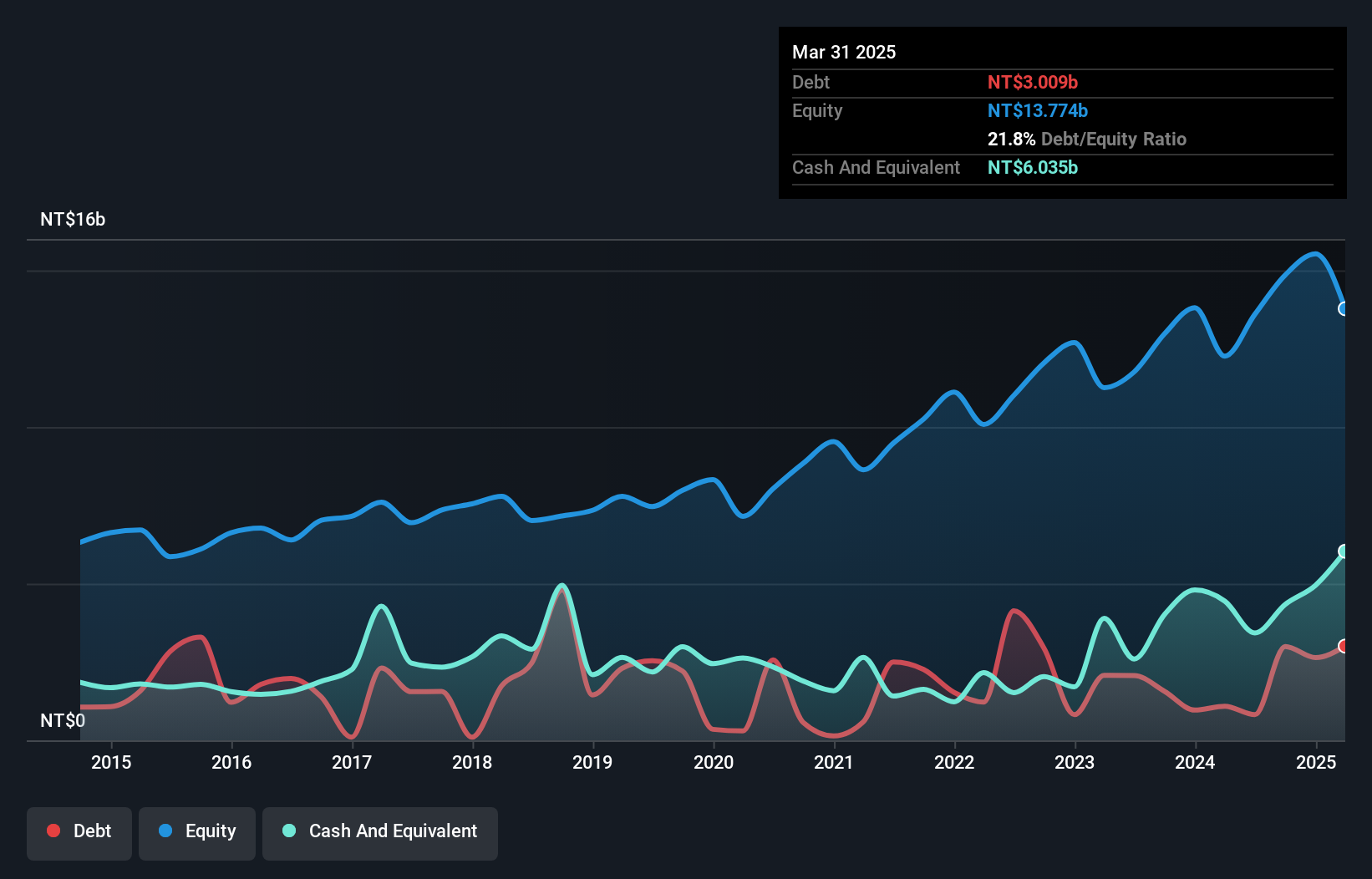

Chicony Power Technology, a smaller player in the tech sector, has shown mixed financial performance recently. Their first-quarter sales for 2025 reached TWD 8.44 billion, up from TWD 8.05 billion last year; however, net income fell to TWD 402.87 million from TWD 680.86 million previously. The basic earnings per share also decreased to TWD 1.01 from TWD 1.7 a year prior, reflecting challenges in maintaining profitability despite revenue growth. On the upside, Chicony is trading at an attractive value compared to peers and boasts high-quality past earnings with positive free cash flow generation over recent periods.

Where To Now?

- Delve into our full catalog of 2652 Asian Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English