Investors Appear Satisfied With Kornit Digital Ltd.'s (NASDAQ:KRNT) Prospects As Shares Rocket 26%

Those holding Kornit Digital Ltd. (NASDAQ:KRNT) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 57%.

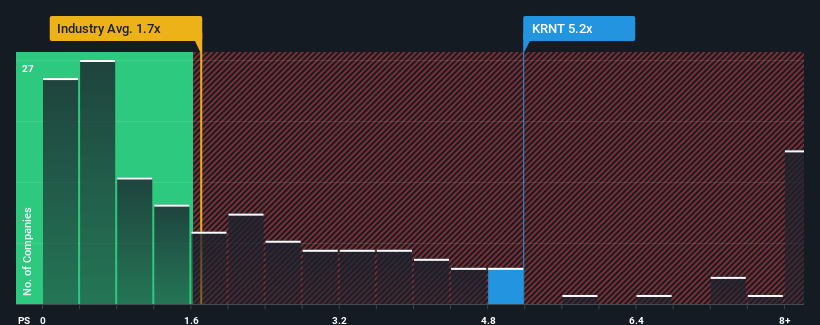

Since its price has surged higher, when almost half of the companies in the United States' Machinery industry have price-to-sales ratios (or "P/S") below 1.7x, you may consider Kornit Digital as a stock not worth researching with its 5.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Kornit Digital

What Does Kornit Digital's P/S Mean For Shareholders?

Kornit Digital's negative revenue growth of late has neither been better nor worse than most other companies. It might be that many expect the company's revenue to strengthen positively despite the tough industry conditions, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kornit Digital.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Kornit Digital would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 4.3% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 39% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 11% as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 0.3%, which is noticeably less attractive.

In light of this, it's understandable that Kornit Digital's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shares in Kornit Digital have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Kornit Digital shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 1 warning sign for Kornit Digital that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English