These Analysts Increase Their Forecasts On Hewlett Packard Enterprise

Hewlett Packard Enterprise Company (NYSE:HPE) on Monday announced enhancements to the portfolio of Nvidia Corp.'s (NASDAQ:NVDA) NVIDIA AI Computing by HPE solutions.

The solution is designed to support the full AI lifecycle and cater to the specific requirements of enterprises, service providers, sovereign entities, and research organizations.

HPE is also introducing new compute and software offerings featuring the NVIDIA RTX PRO 6000 Blackwell Server Edition GPU and the NVIDIA Enterprise AI Factory-validated design.

Antonio Neri, president and CEO of HPE, said, "By co-engineering cutting-edge AI technologies elevated by HPE's robust solutions, we are empowering businesses to harness the full potential of these advancements throughout their organization, no matter where they are on their AI journey."

Hewlett Packard Enterprise Company shares gained 1.5% to trade at $17.73 on Tuesday.

These analysts made changes to their price targets on Hewlett Packard Enterprise Company following the announcement.

- Evercore ISI Group analyst Amit Daryanani upgraded Hewlett Packard from In-Line to Outperform and raised the price target from $17 to $22.

- Morgan Stanley analyst Meta Marshall maintained the stock with an Equal-Weight rating and raised the price target from $14 to $22.

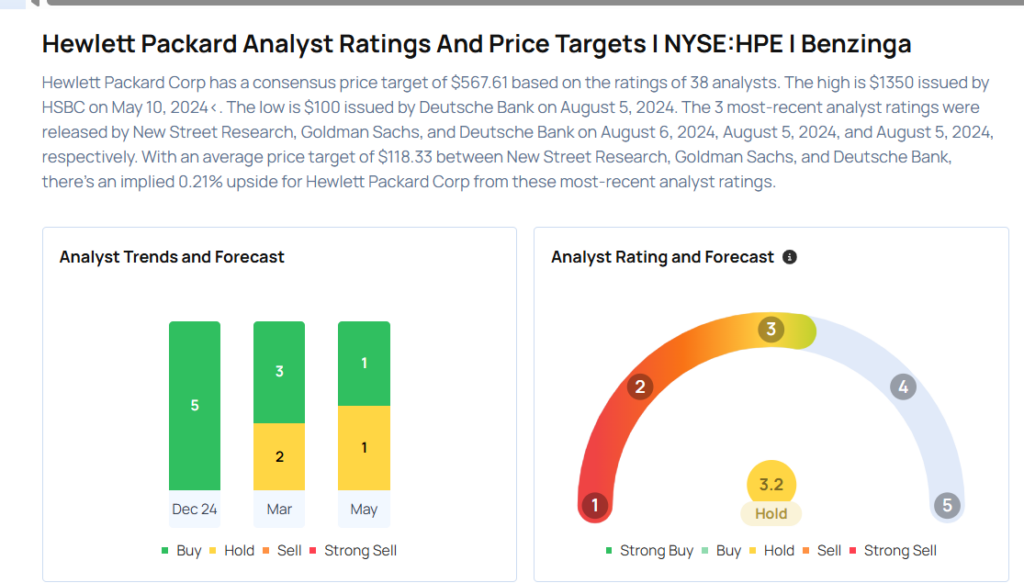

Considering buying HPE stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English