SIGN UP

LOG IN

Top 3 Energy Stocks That May Fall Off A Cliff In Q2

Benzinga·05/21/2025 12:28:43

Listen to the news

As of May 21, 2025, three stocks in the energy sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Natural Gas Services Group, Inc. (NYSE:NGS)

- On May 12, Natural Gas Services Group reported better-than-expected first-quarter financial results. “We are pleased to report another quarter of strong execution and continued momentum across our business,” said Justin Jacobs, Chief Executive Officer. “We are taking market share, expanding our presence in key basins, and investing in our fleet, including the deployment of large-horsepower electric motor units.” The company's stock jumped around 41% over the past month and has a 52-week high of $29.74.

- RSI Value: 78.9

- NGS Price Action: Shares of Natural Gas Services Group gained 2% to close at $25.44 on Tuesday.

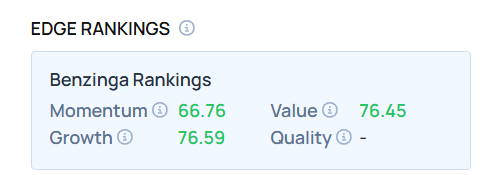

- Edge Stock Ratings: 66.76 Momentum score with Value at 76.45.

KNOT Offshore Partners LP (NYSE:KNOP)

- On May 20, KNOT Offshore Partners posted better-than-expected quarterly earnings. Derek Lowe, Chief Executive Officer and Chief Financial Officer of KNOT Offshore Partners LP, said, “We are pleased to report another strong performance in Q1 2025, marked by safe operation at more than 99% fleet utilization from scheduled operations, consistent revenue and operating income generation, and material progress in securing additional charter coverage for our fleet.” The company's stock gained around 8% over the past month and has a 52-week high of $9.11.

- RSI Value: 73.4

- KNOP Price Action: Shares of KNOT Offshore Partners gained 2.8% to close at $6.87 on Tuesday.

Hafnia Ltd (NYSE:HAFN)

- On May 15, Hafnia posted better-than-expected quarterly sales. Mikael Skov, CEO of Hafnia, said, "The first quarter experienced an increase in trade volumes and tonne-miles, supported by strong global demand resulting in an improved spot market. Sentiment has improved further in the second quarter, setting the stage for a robust remainder of 2025." The company's stock gained around 27% over the past month and has a 52-week high of $8.99.

- RSI Value: 76

- HAFN Price Action: Shares of Hafnia gained 0.8% to close at $5.39 on Tuesday.

BZ Edge Rankings: Find out where other stocks stand—explore the full comparison now.

Read This Next:

Photo via Shutterstock

Risk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.