3 Growth Companies With High Insider Ownership And 161% Earnings Growth

Over the last 7 days, the United States market has experienced a 1.1% drop, yet it has shown resilience with a 9.1% rise over the past year and earnings are projected to grow by 14% annually. In such an environment, growth companies with high insider ownership can be particularly appealing as they often align management's interests with those of shareholders, potentially driving strong performance and strategic growth initiatives.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 25.3% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 67.1% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.2% | 44.6% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 18.4% | 60.6% |

We're going to check out a few of the best picks from our screener tool.

Coastal Financial (NasdaqGS:CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation, with a market cap of $1.34 billion, operates as the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region of Washington.

Operations: Coastal Financial's revenue is primarily derived from three segments: CCBX ($222.52 million), Community Bank ($84.07 million), and Treasury & Administration ($15.57 million).

Insider Ownership: 14.5%

Earnings Growth Forecast: 48% p.a.

Coastal Financial demonstrates robust growth potential with earnings forecasted to grow by 48% annually, outpacing the US market's 14.3%. Recent earnings reported net income of US$9.73 million, up from US$6.8 million a year ago, despite significant insider selling in the last quarter. The stock trades at 32.5% below its estimated fair value and analysts expect a price increase of 22.7%. Executive changes include the CFO's planned departure later this year.

- Unlock comprehensive insights into our analysis of Coastal Financial stock in this growth report.

- The valuation report we've compiled suggests that Coastal Financial's current price could be quite moderate.

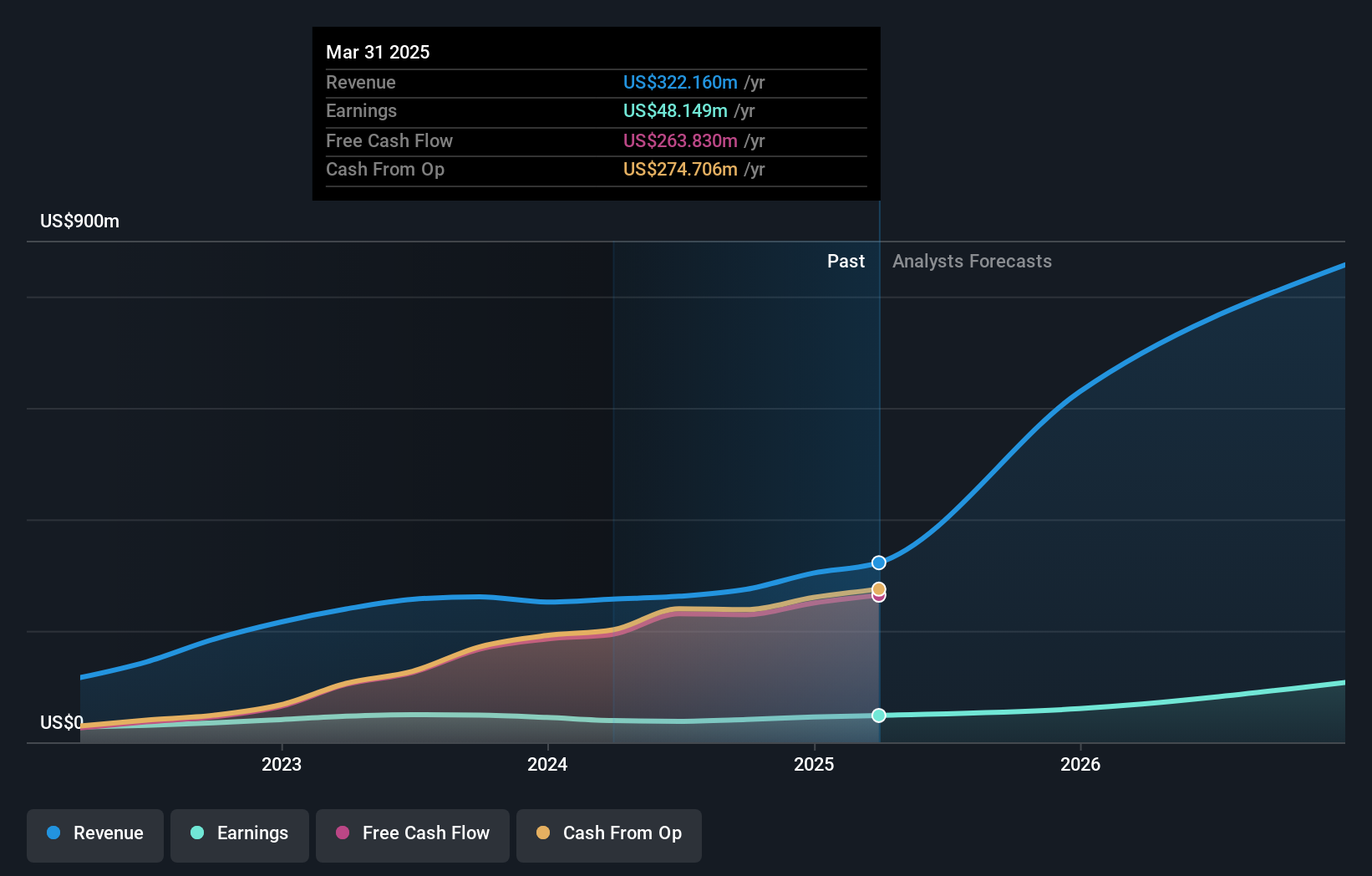

Simulations Plus (NasdaqGS:SLP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Simulations Plus, Inc. specializes in creating drug discovery and development software that leverages artificial intelligence and machine learning for modeling, simulation, and molecular property prediction, with a market capitalization of approximately $645.26 million.

Operations: The company's revenue is derived from two main segments: Services, which generated $32.54 million, and Software, contributing $46.02 million.

Insider Ownership: 17.3%

Earnings Growth Forecast: 38.5% p.a.

Simulations Plus is poised for significant growth, with earnings expected to rise 38.5% annually, surpassing the US market's average. Despite a decline in net profit margins from 16.3% to 9.2%, revenue is projected to grow between 28% and 33% this year, reaching up to US$93 million. The company recently launched DILIsym 11 and supports the FDA's roadmap for reducing animal testing, enhancing its role in computational modeling and regulatory compliance within the pharmaceutical sector.

- Delve into the full analysis future growth report here for a deeper understanding of Simulations Plus.

- According our valuation report, there's an indication that Simulations Plus' share price might be on the expensive side.

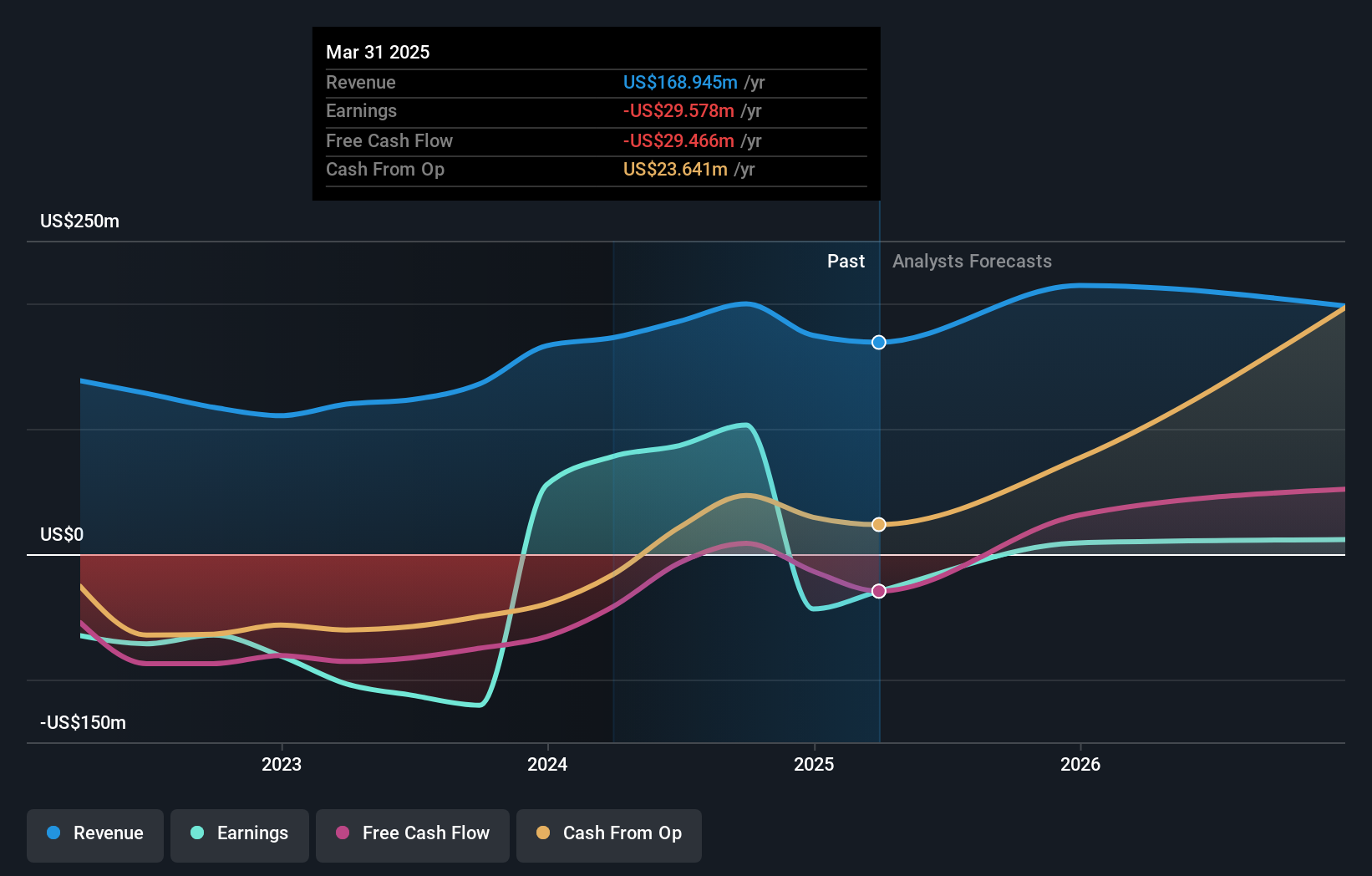

McEwen Mining (NYSE:MUX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: McEwen Mining Inc. is involved in the exploration, development, production, and sale of gold and silver deposits across the United States, Canada, Mexico, and Argentina with a market cap of $405.99 million.

Operations: The company's revenue segments include $66.36 million from Canada and $102.26 million from the United States of America (USA).

Insider Ownership: 15.7%

Earnings Growth Forecast: 161.9% p.a.

McEwen Mining is forecasted to achieve profitability within three years, with earnings expected to grow significantly above the market average. Despite a recent quarterly net loss of US$6.27 million, this reflects an improvement from a larger loss last year. The company's revenue growth is projected at 18.8% annually, outpacing the US market average. Recent exploration updates at the Grey Fox Project indicate promising results, potentially enhancing future production capabilities and resource estimates for gold extraction activities.

- Click here to discover the nuances of McEwen Mining with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that McEwen Mining is trading behind its estimated value.

Key Takeaways

- Investigate our full lineup of 189 Fast Growing US Companies With High Insider Ownership right here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English