On Holding (NYSE:ONON) Amends Bylaws and Adds Former H&M CEO to Board

On Holding (NYSE:ONON) has undergone notable governance and leadership updates, including amendments to its Articles of Association and the election of Helena Helmersson to its Board of Directors. These changes may bolster the company's strategic and operational framework. Over the last month, the company's stock rose by 33%, amidst broader market contracted by 2.7% over the last week. The rise in On Holding's stock price contrasts sharply with the short-term market downturn, perhaps aided by financial guidance updates predicting robust revenue growth, suggesting stronger investor confidence in its future prospects.

Buy, Hold or Sell On Holding? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent changes in On Holding's governance, with amendments to its Articles of Association and the inclusion of Helena Helmersson on its Board, are likely to influence the company's strategic direction positively. These updates could enhance On Holding's operational framework, potentially leading to improved decision-making processes that align with its ambitious growth plans. This aligns with the company's focus on revenue generation through brand positioning and geographic expansion as highlighted in current analyses.

On Holding's stock performance over the last three years has been remarkable, with a total shareholder return of 178.29%. This long-term growth reflects strong investor confidence in the company's direction, despite the broader market experiencing just 9% growth over the past year. Notably, On Holding also outperformed the US Luxury industry, which saw a decline of 13.1% during the same one-year period.

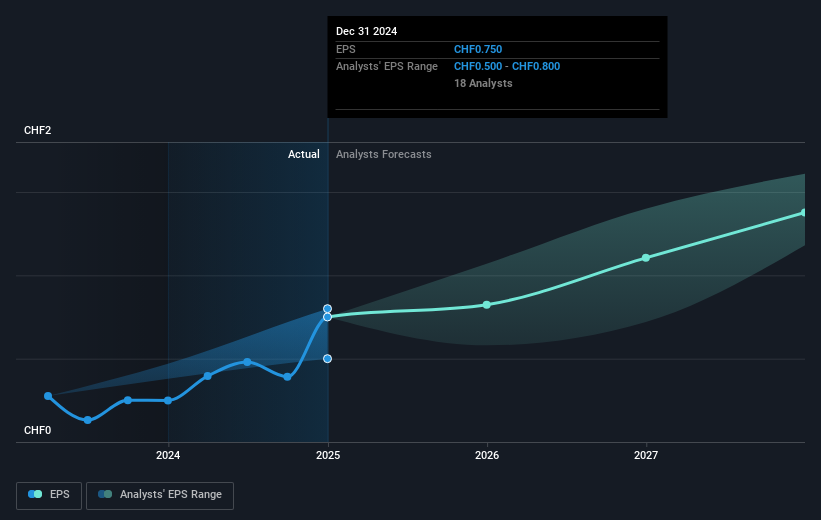

The leadership updates may also influence financial forecasts, as optimism regarding robust governance can boost investor confidence and lead to upward revisions in revenue and earnings projections. Analysts have set a consensus price target of CHF62.59 for On Holding, which represents a 23.5% potential increase from the current share price of CHF47.9. This gap highlights a belief in the company's future growth prospects, supported by its strategic initiatives and potential scalability.

Gain insights into On Holding's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English