Despite shrinking by US$225m in the past week, Kingsoft Cloud Holdings (NASDAQ:KC) shareholders are still up 347% over 1 year

The last three months have been tough on Kingsoft Cloud Holdings Limited (NASDAQ:KC) shareholders, who have seen the share price decline a rather worrying 31%. But over the last year the share price has taken off like one of Elon Musk's rockets. Few could complain about the impressive 347% rise, throughout the period. So we wouldn't blame sellers for taking some profits. The real question is whether the fundamental business performance can justify the strong increase over the long term.

Although Kingsoft Cloud Holdings has shed US$225m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Kingsoft Cloud Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Kingsoft Cloud Holdings grew its revenue by 10% last year. That's not great considering the company is losing money. So it's truly surprising that the share price rocketed 347% in a single year. We're happy that investors have made money, but we can't help questioning whether the rise is sustainable. It just goes to show that big money can be made if you buy the right stock early.

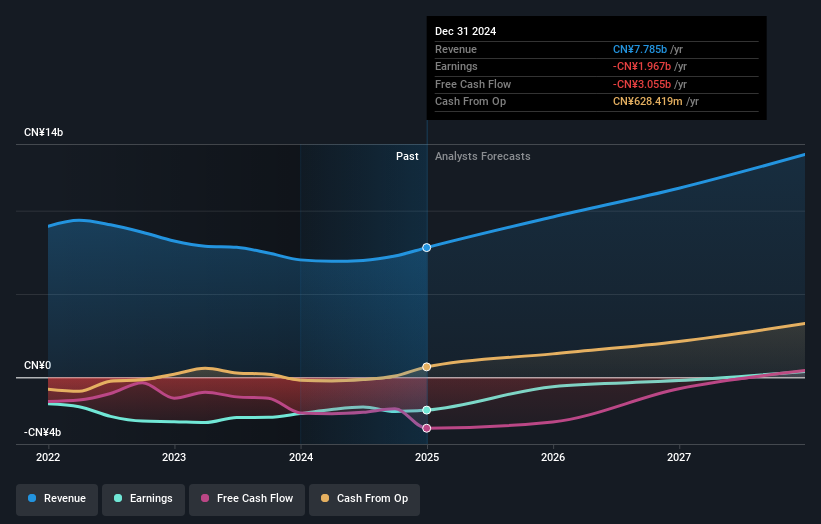

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Kingsoft Cloud Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It's nice to see that Kingsoft Cloud Holdings shareholders have received a total shareholder return of 347% over the last year. There's no doubt those recent returns are much better than the TSR loss of 7% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Kingsoft Cloud Holdings .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English