Expand Energy And 2 Stocks That Might Be Priced Below Their Estimated Worth

The United States market has been flat over the last week but is up 11% over the past year, with earnings forecast to grow by 14% annually. In this environment, identifying stocks that are potentially undervalued can be a strategic move for investors looking to capitalize on growth opportunities while navigating a stable yet promising market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Berkshire Hills Bancorp (NYSE:BHLB) | $25.40 | $50.02 | 49.2% |

| Brookline Bancorp (NasdaqGS:BRKL) | $10.59 | $21.02 | 49.6% |

| Horizon Bancorp (NasdaqGS:HBNC) | $15.03 | $29.84 | 49.6% |

| WesBanco (NasdaqGS:WSBC) | $31.44 | $62.71 | 49.9% |

| Hims & Hers Health (NYSE:HIMS) | $53.36 | $106.29 | 49.8% |

| Insteel Industries (NYSE:IIIN) | $36.58 | $71.98 | 49.2% |

| Array Technologies (NasdaqGM:ARRY) | $7.00 | $13.84 | 49.4% |

| Lincoln Educational Services (NasdaqGS:LINC) | $23.03 | $45.46 | 49.3% |

| Verra Mobility (NasdaqCM:VRRM) | $24.11 | $47.86 | 49.6% |

| Expand Energy (NasdaqGS:EXE) | $117.28 | $231.50 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

Expand Energy (NasdaqGS:EXE)

Overview: Expand Energy Corporation is an independent natural gas production company operating in the United States, with a market cap of $27.60 billion.

Operations: The company generates revenue primarily from its exploration and production segment, totaling $6.57 billion.

Estimated Discount To Fair Value: 49.3%

Expand Energy appears undervalued based on cash flows, with shares trading at US$117.28, significantly below the estimated fair value of US$231.5. Despite a challenging first quarter with a net loss of US$249 million, revenue nearly doubled to US$2.2 billion year-over-year. The company is forecasted to grow earnings by 43.9% annually and become profitable within three years, outpacing the broader market's growth expectations while maintaining its dividend payments amidst shareholder dilution concerns.

- The growth report we've compiled suggests that Expand Energy's future prospects could be on the up.

- Navigate through the intricacies of Expand Energy with our comprehensive financial health report here.

Coherent (NYSE:COHR)

Overview: Coherent Corp. is a company that specializes in developing, manufacturing, and marketing engineered materials and optoelectronic components for various global markets, with a market cap of approximately $12.20 billion.

Operations: The company's revenue is derived from three main segments: Lasers ($1.45 billion), Materials ($1.52 billion), and Networking ($3.21 billion).

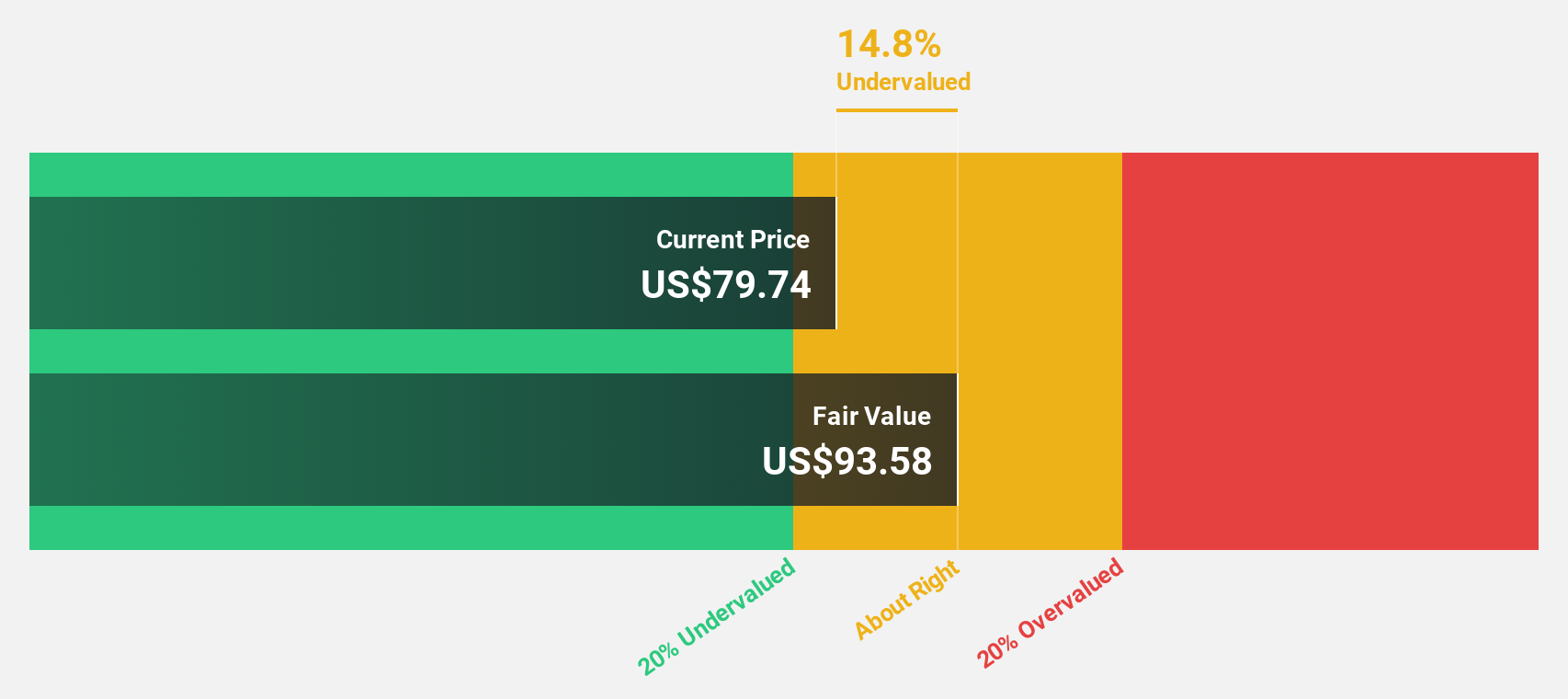

Estimated Discount To Fair Value: 11.7%

Coherent is trading at US$81.19, below its estimated fair value of US$91.98, indicating potential undervaluation based on cash flows. The company reported a third-quarter revenue increase to US$1.5 billion from US$1.2 billion year-over-year and achieved a net income of US$15.71 million compared to a previous net loss. Despite high share price volatility, Coherent's earnings are forecasted to grow significantly by 96% annually, although revenue growth is expected to be slower than the market average.

- The analysis detailed in our Coherent growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Coherent.

Oracle (NYSE:ORCL)

Overview: Oracle Corporation provides products and services for enterprise information technology environments globally, with a market cap of approximately $437.38 billion.

Operations: Oracle's revenue is primarily derived from three segments: Cloud and License at $47.60 billion, Services at $5.26 billion, and Hardware at $2.93 billion.

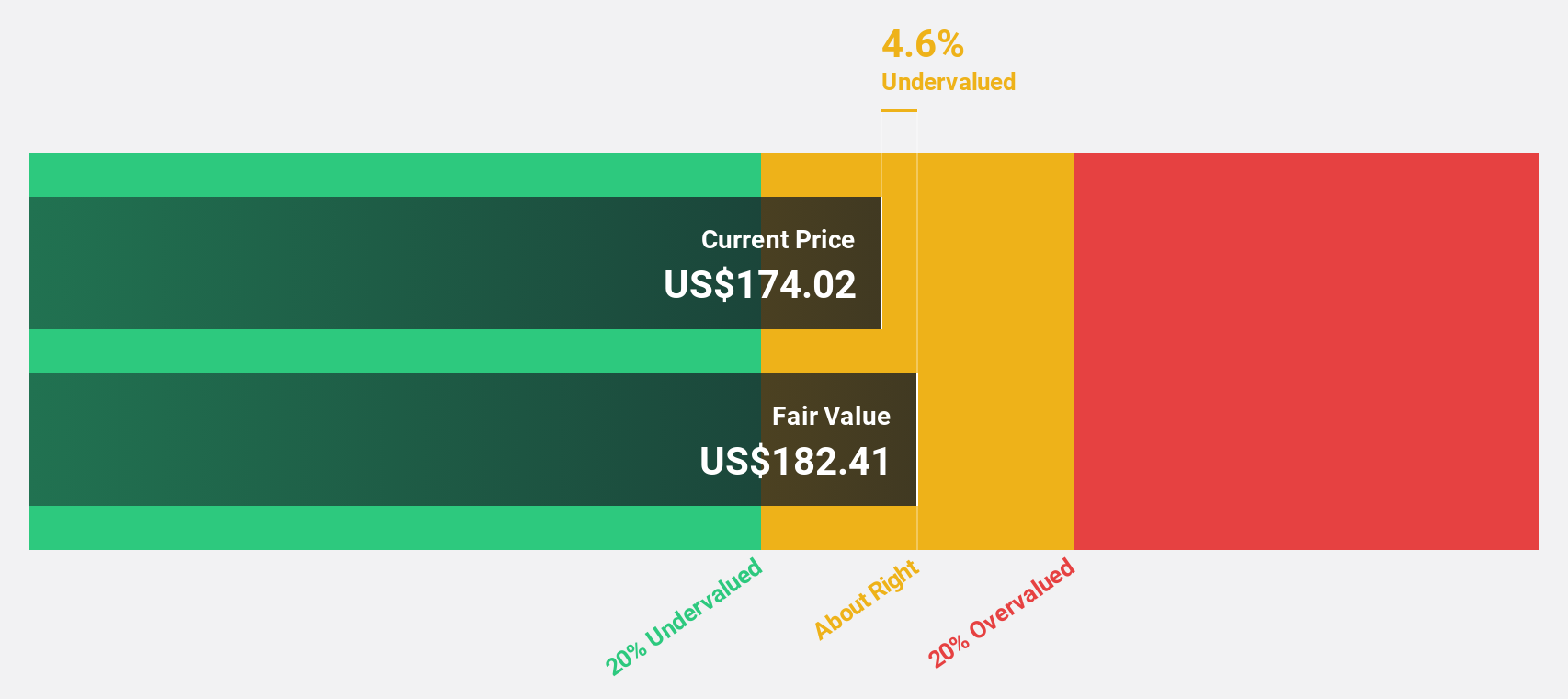

Estimated Discount To Fair Value: 33.6%

Oracle's stock is trading at US$161.91, significantly below its estimated fair value of US$243.92, highlighting potential undervaluation based on cash flows. The company is part of a strategic alliance for the Stargate UAE AI infrastructure project, potentially enhancing future revenue streams. Despite high debt levels, Oracle's earnings are forecasted to grow faster than the market average at 16.6% annually, with a very high return on equity expected in three years.

- According our earnings growth report, there's an indication that Oracle might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Oracle.

Summing It All Up

- Explore the 171 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English