What Analysts Are Saying About Olin Stock

Providing a diverse range of perspectives from bullish to bearish, 16 analysts have published ratings on Olin (NYSE:OLN) in the last three months.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 13 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 6 | 1 | 0 |

| 2M Ago | 0 | 1 | 6 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

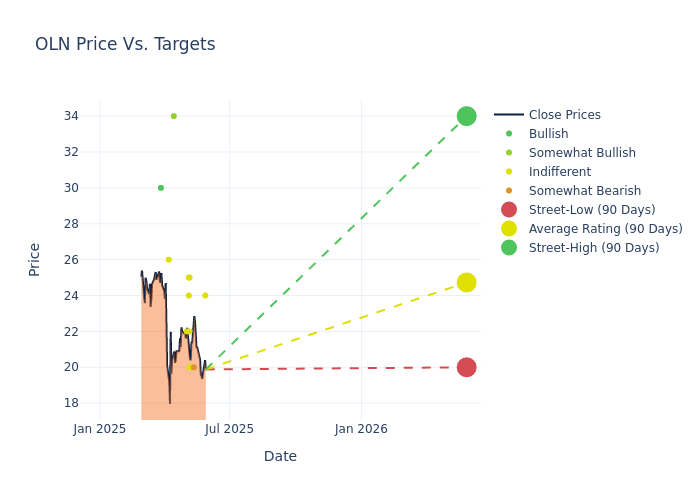

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $24.38, with a high estimate of $34.00 and a low estimate of $19.00. Experiencing a 17.52% decline, the current average is now lower than the previous average price target of $29.56.

Decoding Analyst Ratings: A Detailed Look

The perception of Olin by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Leithead | Barclays | Lowers | Equal-Weight | $24.00 | $28.00 |

| Angel Castillo | Morgan Stanley | Lowers | Underweight | $20.00 | $28.00 |

| Duffy Fischer | Goldman Sachs | Lowers | Neutral | $25.00 | $33.00 |

| Jeffrey Zekauskas | JP Morgan | Lowers | Neutral | $20.00 | $28.00 |

| Michael Sison | Wells Fargo | Raises | Equal-Weight | $22.00 | $19.00 |

| Peter Osterland | Truist Securities | Lowers | Hold | $24.00 | $25.00 |

| Arun Viswanathan | RBC Capital | Lowers | Sector Perform | $25.00 | $28.00 |

| Joshua Spector | UBS | Raises | Neutral | $22.00 | $21.00 |

| Aleksey Yefremov | Keybanc | Lowers | Overweight | $34.00 | $40.00 |

| Peter Osterland | Truist Securities | Lowers | Hold | $25.00 | $32.00 |

| Michael Sison | Wells Fargo | Lowers | Equal-Weight | $19.00 | $25.00 |

| Joshua Spector | UBS | Lowers | Neutral | $21.00 | $34.00 |

| Charles Neivert | Piper Sandler | Lowers | Neutral | $26.00 | $33.00 |

| Michael Sison | Wells Fargo | Lowers | Equal-Weight | $25.00 | $31.00 |

| Michael Leithead | Barclays | Lowers | Equal-Weight | $28.00 | $34.00 |

| Patrick Cunningham | Citigroup | Lowers | Buy | $30.00 | $34.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Olin. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Olin compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Olin's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Olin's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Olin analyst ratings.

Unveiling the Story Behind Olin

Olin Corp manufactures and sells a variety of chemicals and chemical-based products. The company organizes itself into three segments based on the product type. The Chlor alkali products and Vinyls segment, which generates the majority of revenue, sells chlorine and caustic soda, which are used in a variety of industries including cosmetics, textiles, crop protection, and fire protection products. The Epoxy segment sells epoxy resins used in paints and coatings. The Winchester segment sells sporting ammunition and ammunition accessories under the Winchester brand. The majority of revenue comes from the United States.

Breaking Down Olin's Financial Performance

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Olin displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 0.54%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Materials sector.

Net Margin: Olin's net margin is impressive, surpassing industry averages. With a net margin of 0.07%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 0.06%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Olin's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.02%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 1.66, Olin faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English