Investors Don't See Light At End Of Twist Bioscience Corporation's (NASDAQ:TWST) Tunnel And Push Stock Down 25%

Twist Bioscience Corporation (NASDAQ:TWST) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

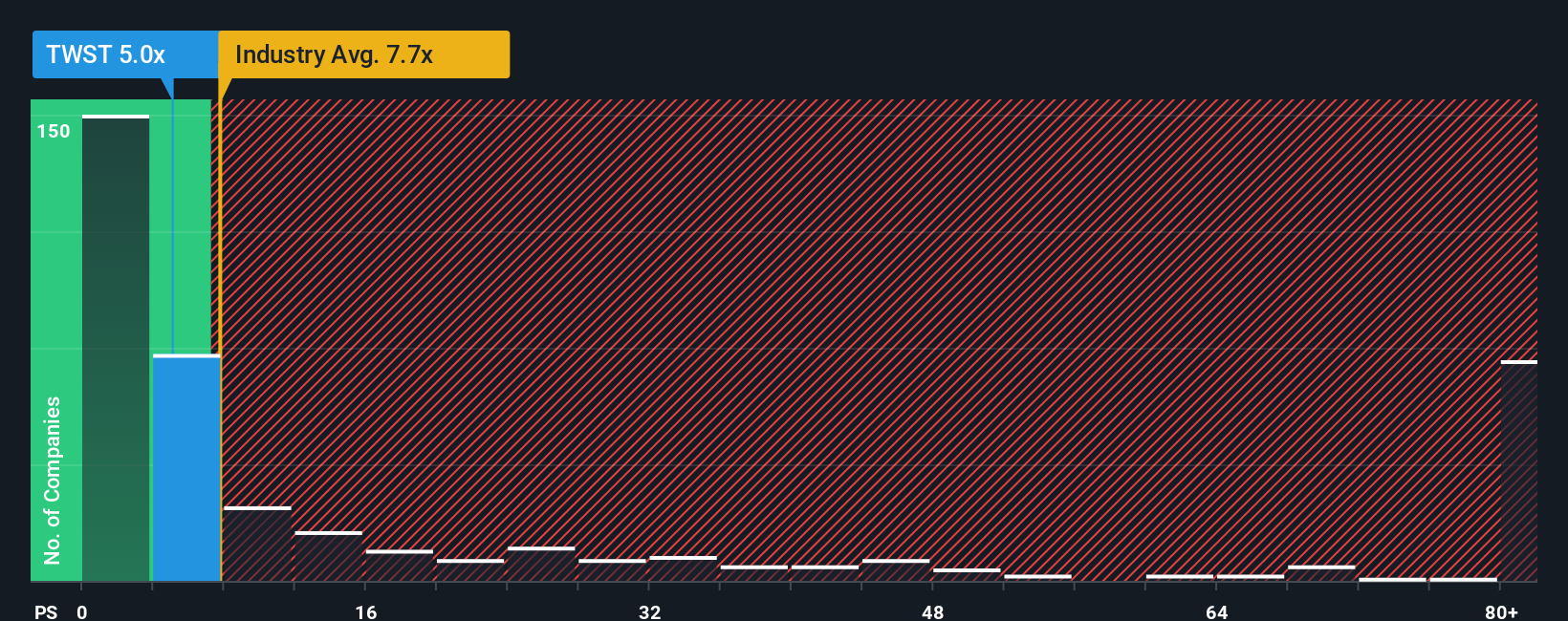

After such a large drop in price, Twist Bioscience may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 5x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 7.7x and even P/S higher than 45x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Twist Bioscience

How Has Twist Bioscience Performed Recently?

Recent times haven't been great for Twist Bioscience as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Twist Bioscience's future stacks up against the industry? In that case, our free report is a great place to start.How Is Twist Bioscience's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Twist Bioscience's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 25% gain to the company's top line. The latest three year period has also seen an excellent 113% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 18% each year during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 159% per year, which is noticeably more attractive.

In light of this, it's understandable that Twist Bioscience's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Twist Bioscience's P/S

Twist Bioscience's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Twist Bioscience's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Twist Bioscience is showing 2 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English