The Analyst Verdict: Paychex In The Eyes Of 5 Experts

Analysts' ratings for Paychex (NASDAQ:PAYX) over the last quarter vary from bullish to bearish, as provided by 5 analysts.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 4 | 0 | 0 |

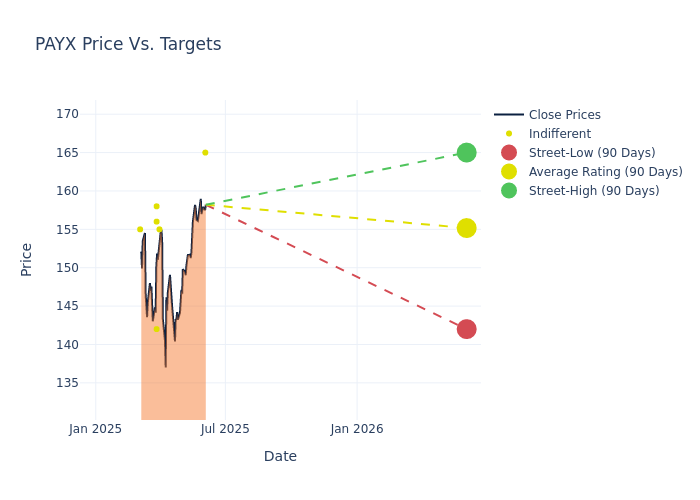

The 12-month price targets, analyzed by analysts, offer insights with an average target of $155.2, a high estimate of $165.00, and a low estimate of $142.00. Observing a 9.14% increase, the current average has risen from the previous average price target of $142.20.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Paychex's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ashish Sabadra | RBC Capital | Raises | Sector Perform | $165.00 | $148.00 |

| Ramsey El-Assal | Barclays | Raises | Equal-Weight | $155.00 | $140.00 |

| James Faucette | Morgan Stanley | Raises | Equal-Weight | $142.00 | $137.00 |

| Peter Christiansen | Citigroup | Raises | Neutral | $158.00 | $145.00 |

| Bryan Bergin | Stifel | Raises | Hold | $156.00 | $141.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Paychex. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Paychex compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Paychex's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

To gain a panoramic view of Paychex's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Paychex analyst ratings.

Unveiling the Story Behind Paychex

Paychex is a technology company providing human capital management solutions, enabling clients to better implement payroll, talent, time, tax, and benefits administration. It has a diverse set of product offerings addressing client needs. Aside from its traditional cloud-based payroll and HCM software offering, which accounts for close to half of total revenue, the company provides outsourcing options. Paychex's administrative service organization and professional employer organization accounts generate over 40% of sales. The balance of revenue is generated through retirement services, insurance solutions, and other products. In fiscal 2024, the company had 745,000 clients and over 2.3 million worksite employees across its ASO and PEO.

Financial Milestones: Paychex's Journey

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Paychex's revenue growth over a period of 3M has been noteworthy. As of 28 February, 2025, the company achieved a revenue growth rate of approximately 4.84%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 34.41%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Paychex's ROE excels beyond industry benchmarks, reaching 12.91%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Paychex's ROA excels beyond industry benchmarks, reaching 4.77%. This signifies efficient management of assets and strong financial health.

Debt Management: Paychex's debt-to-equity ratio is below the industry average at 0.21, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English