Asian Market Gems: Penny Stock Highlights For June 2025

As the Asian markets navigate a complex landscape of global trade tensions and economic shifts, investors are increasingly seeking opportunities that offer both potential growth and resilience. Penny stocks, though often associated with riskier investments, can still present valuable prospects when grounded in strong financials and clear growth paths. This article explores three such penny stocks in Asia that stand out for their robust balance sheets and potential to thrive amid current market dynamics.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.102 | SGD43.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.176 | SGD35.06M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.21 | SGD8.7B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 3 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.90 | HK$3.28B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.39 | HK$50.26B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.99 | HK$1.66B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,160 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$8.33 billion, operates in the People's Republic of China providing burial and funeral services through its subsidiaries.

Operations: The company's revenue is primarily derived from its burial services at CN¥1.71 billion and funeral services at CN¥339.19 million, with additional contributions from other services totaling CN¥37.44 million.

Market Cap: HK$8.33B

Fu Shou Yuan International Group, with a market cap of HK$8.33 billion, recently declared a final dividend of HKD 0.0954 per share for 2024, despite facing challenges such as decreased revenue and net income compared to the previous year. The company's profit margins have declined from 30.1% to 18%, reflecting economic pressures and cautious consumer spending in China. While its board is experienced and debt levels are well-managed with more cash than total debt, the management team is relatively new, averaging only 1.8 years in tenure. Earnings are forecasted to grow at nearly 9% annually moving forward.

- Click here to discover the nuances of Fu Shou Yuan International Group with our detailed analytical financial health report.

- Gain insights into Fu Shou Yuan International Group's outlook and expected performance with our report on the company's earnings estimates.

Lepu Biopharma (SEHK:2157)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lepu Biopharma Co., Ltd. is a biopharmaceutical company specializing in the discovery, development, and commercialization of innovative anti-tumor targeted therapies and oncology immunotherapies globally, with a market cap of HK$8.13 billion.

Operations: The company generates revenue of CN¥367.79 million from the sales of pharmaceutical products and the research and development of new drugs.

Market Cap: HK$8.13B

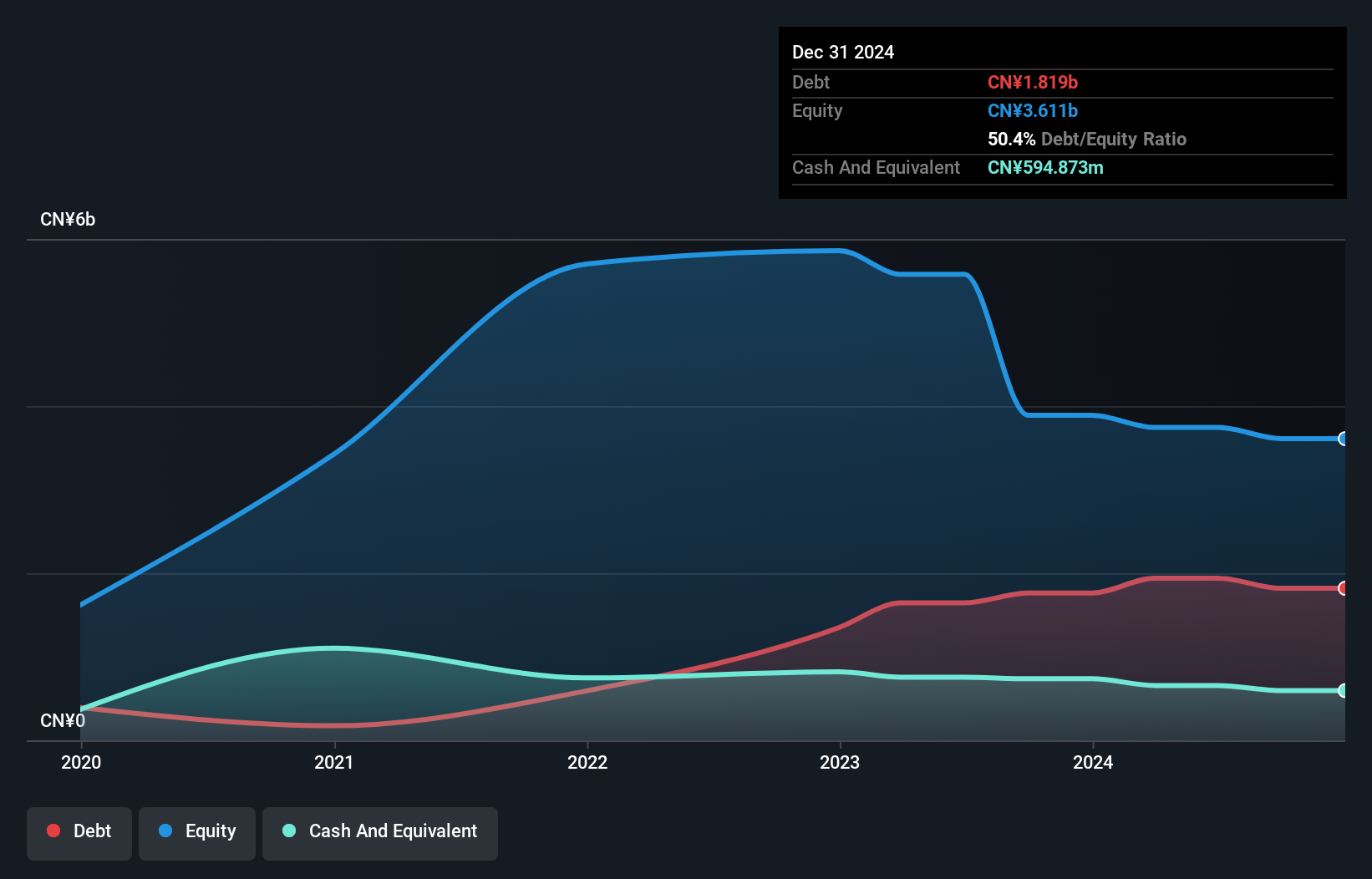

Lepu Biopharma, with a market cap of HK$8.13 billion, is navigating the complexities of the biotech sector while remaining pre-revenue. Recent pivotal clinical trial results for MRG003, targeting nasopharyngeal cancer, show promising efficacy and safety compared to chemotherapy. Despite these advancements, the company faces financial challenges with a net loss of CN¥411.38 million in 2024 and high volatility in its share price. Its management team is experienced with an average tenure of 3.2 years, but it grapples with high debt levels and short-term liabilities exceeding its assets by CN¥354.5 million.

- Navigate through the intricacies of Lepu Biopharma with our comprehensive balance sheet health report here.

- Gain insights into Lepu Biopharma's past trends and performance with our report on the company's historical track record.

AIM Vaccine (SEHK:6660)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AIM Vaccine Co., Ltd. focuses on researching, developing, manufacturing, and commercializing vaccine products for human use in the People’s Republic of China, with a market cap of HK$4.82 billion.

Operations: The company's revenue is primarily derived from the sale of vaccines and research and development services, totaling CN¥1.29 billion.

Market Cap: HK$4.82B

AIM Vaccine, with a market cap of HK$4.82 billion, is advancing in the biotech sector with innovative mRNA vaccines. The recent dual approval for its mRNA herpes zoster vaccine by the FDA and China's National Medical Products Administration highlights its technological prowess. Despite reporting CN¥1.29 billion in revenue, AIM remains unprofitable with a net loss of CN¥277.23 million in 2024 and faces challenges such as high share price volatility and short-term liabilities exceeding assets by CN¥700 million. However, it benefits from an experienced management team and sufficient cash runway to support ongoing R&D efforts.

- Dive into the specifics of AIM Vaccine here with our thorough balance sheet health report.

- Learn about AIM Vaccine's future growth trajectory here.

Taking Advantage

- Reveal the 1,160 hidden gems among our Asian Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English